Importe pendiente KPI

Importe pendiente El importe pendiente es el total de cuotas impagadas que los distribuidores o socios comerciales adeudan a la marca por productos facturados pero aún no pagados. Refleja el riesgo de crédito, la salud de la tesorería y la disciplina de los distribuidores en los distintos territorios.

Para las marcas de bienes de consumo, la gestión de este KPI garantiza la liquidez, reduce las deudas incobrables y ayuda a los equipos de ventas a alinear el crecimiento con el cumplimiento financiero.

Por qué es importante el importe pendiente

- Afecta a la tesorería de la empresa y a la eficiencia del capital circulante

- Indica la exposición crediticia entre socios y geografías

- Permite evaluar mejor los riesgos durante la incorporación de los distribuidores

- Apoya la planificación del crecimiento territorial alineada con las finanzas

- Ayuda a los equipos sobre el terreno a rendir cuentas de los cobros

Cómo medir el saldo vivo

El importe total facturado que aún no se ha cobrado a los distribuidores dentro del plazo de crédito acordado.

Fórmula:

Importe pendiente = Importe total facturado - Total de pagos cobrados (dentro del periodo de crédito)

Ejemplo: Si se facturaron $300.000 y se cobraron $240.000 en un plazo de 30 días, Pendiente = $60.000

Los datos suelen rastrearse a través de sistemas ERP o de gestión de distribuidores (DMS) y segmentarse por territorio, antigüedad del crédito o socio de canal.

Qué impulsa el importe pendiente

- Disciplina de pago de los distribuidores

- Condiciones de crédito y mecanismos de ejecución

- Seguimiento de la recogida por los equipos sobre el terreno

- Exactitud de las facturas y resolución de litigios

- Madurez de las relaciones comerciales y capacidad financiera

Analicemos un subindicador clave: Pago cobrado

Sub-KPI: ¿Qué es el pago cobrado?

Valor total de los pagos recibidos de los socios comerciales por facturas emitidas dentro de un plazo definido.

Por qué es importante

- Reduce directamente el saldo pendiente y mejora el flujo de caja

- Refleja la eficacia del seguimiento sobre el terreno y la gestión del crédito

- Apoya la evaluación del rendimiento de los socios y las regiones

Cómo se mide

Pago cobrado = Valor total de las facturas pagadas antes de la fecha de vencimiento

Cómo mejorarlo

- Seguimiento de los cobros con cubos de antigüedad y cuadros de mando diarios

- Incentivar a los representantes y socios para que paguen a tiempo

- Resolver rápidamente los litigios sobre facturas para evitar retrasos en los pagos

- Educar a los socios en la política crediticia y penalizar a los morosos habituales

Cómo impulsa este subindicador clave de rendimiento el importe pendiente de cobro

Un cobro mayor y puntual de los pagos reduce el importe total pendiente, mejorando la salud financiera y permitiendo la futura escalabilidad de la empresa.

Cómo impulsar la ejecución a escala

- Fijar objetivos de recaudación a nivel de territorio, representante o distribuidor.

- Supervisar la antigüedad de los pagos y alertar a los representantes de retrasos críticos.

- Alinee los días de crédito y los descuentos con el comportamiento de pago

- Utilizar herramientas móviles de registro de la recogida

- Recompensar a los territorios poco destacados para impulsar la concentración sobre el terreno

Cómo puede ayudar BeatRoute

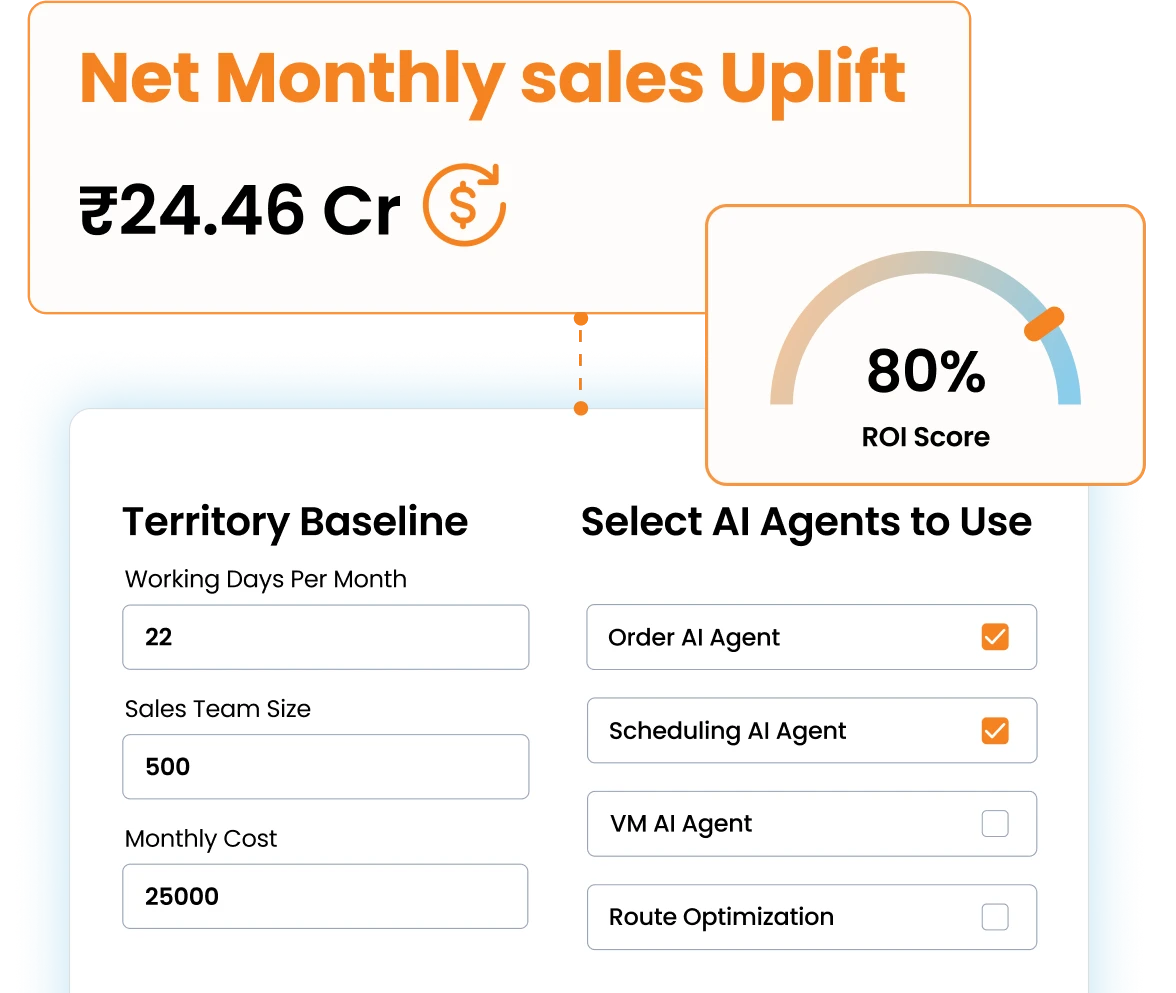

Aquí es donde entra en juego el marco Goal-Driven AI de BeatRoute.

- Establecer objetivos de reducción de impagados por distribuidor y realizar un seguimiento del rendimiento en tiempo real a través de cuadros de mando que muestren el progreso de los cobros, los importes vencidos y la exposición crediticia.

- Capacite a los representantes con flujos de trabajo AI como Scheduling AI, que prioriza las visitas de pago en función del riesgo de antigüedad, y avisos automatizados que incluyen recordatorios de facturas y confirmación de saldo a través de la aplicación del equipo de ventas o la aplicación del cliente. Agilice los cobros con la conciliación fotoverificada de las entradas de pago al final del día.

- Gamifique el comportamiento de cobro mediante tablas de clasificación y tarjetas de puntuación que reconocen a los representantes y distribuidores por los pagos puntuales, la reducción de los días de retraso y la limpieza de los informes de antigüedad.

- Resuelva los riesgos de pago con BeatRoute Copilot, que señala las cuentas de mayor antigüedad y los grupos de retrasos en los pagos y, a continuación, ofrece a los gestores mensajes conversacionales como "¿Qué socios llevan más de 45 días de retraso?" y recomienda acciones de recuperación.

Conclusión

El importe pendiente es un KPI financiero vital que vincula el crecimiento comercial con la disciplina en los cobros. Gestionarlo bien crea relaciones sostenibles con los distribuidores y garantiza la continuidad del negocio a largo plazo.

👉Este KPI es una métrica de ejecución básica reconocida en todo el sector mundial de bienes de consumo y bienes de gran consumo. Se utiliza ampliamente para medir el rendimiento sobre el terreno, el impacto a nivel de punto de venta y la eficacia de la ejecución de ventas. El seguimiento de este KPI ayuda a las marcas minoristas a alinear la ejecución local y nacional con objetivos empresariales más amplios como la estrategia de crecimiento, la expansión del mercado y la rentabilidad.

Sobre el autor

-

Kanika Agrawal owns deep first-hand market experience ranging from global corporations to startups, where she has contributed to building and scaling solutions that drive measurable business impact. She possesses strong expertise in AI and focuses on translating its capabilities into real business value.

Utilice Goal-Driven AI para aumentar sus ventas al por menor, ¡hoy mismo!

Únase a empresas de más de 20 países que confían en BeatRoute, la plataforma AI dominante en todo el mundo para la automatización de la fuerza de ventas, ventas sobre el terreno, DMS y eB2B.

Últimos artículos

Aquí tiene los artículos, actualizaciones de plataformas, libros electrónicos e informes más impactantes para usted.