KPI Indeks Pengembangan Pasar

Indeks Pengembangan Pasar (MDI) mengukur sejauh mana sebuah merek atau kategori telah menembus pasar tertentu dibandingkan dengan potensinya. Hal ini mencerminkan ruang pertumbuhan dan membantu merek mengidentifikasi geografi atau segmen pelanggan yang kurang ditembus.

Untuk merek barang konsumsi, MDI adalah KPI strategis yang memandu perencanaan ekspansi, peluncuran inovasi, dan alokasi sumber daya pemasaran.

Mengapa Indeks Perkembangan Pasar Penting

- Mengidentifikasi pasar yang belum tersentuh atau berkinerja buruk dengan potensi pertumbuhan

- Membantu tolok ukur kinerja regional relatif terhadap norma-norma kategori

- Mendukung pengambilan keputusan yang tepat untuk distribusi, aktivasi, atau pengeluaran media

- Kejenuhan pasar bendera vs. peluang untuk perluasan kategori

- Memberikan arahan strategis untuk inisiatif-inisiatif yang masuk ke pasar

Cara Mengukur Indeks Perkembangan Pasar

MDI membandingkan penjualan pasar aktual dengan total penjualan potensial di suatu wilayah atau segmen tertentu.

Formula:

MDI = (Penjualan per Kapita Saat Ini di Pasar Sasaran / Penjualan per Kapita di Pasar Tolok Ukur) × 100%

Contoh: Jika penjualan per kapita di Kota A = $5 dan di Kota B = $10, maka MDI Kota A = 50%, yang mengindikasikan keterbelakangan.

MDI biasanya dilacak di tingkat kabupaten, wilayah, atau klaster demografis dengan menggunakan data konsumsi, laporan saluran, dan tolok ukur eksternal.

Apa yang Mendorong Indeks Perkembangan Pasar

- Penetrasi saluran dan distribusi numerik dalam geografi target

- Kesadaran kategori dan aktivitas promosi

- Perilaku konsumen lokal dan kondisi ekonomi

- Penyelarasan harga, relevansi ukuran kemasan, dan keterjangkauan

- Intensitas dan pangsa pasar yang kompetitif

Mari kita jelajahi dua sub KPI strategis: Indeks Musiman dan Tingkat Kanibalisasi

Sub-KPI: Apa Itu Indeks Musiman?

Indeks Musiman mengukur fluktuasi kinerja penjualan yang disebabkan oleh pola permintaan musiman atau siklus.

Mengapa Ini Penting

- Membantu meramalkan dan merencanakan inventaris atau kampanye di sekitar lonjakan permintaan

- Menghindari kehabisan stok atau kelebihan stok selama siklus puncak/di luar puncak

- Mendukung pengaturan waktu kategori dan penyelarasan dorongan perdagangan

Bagaimana Cara Mengukurnya

Indeks Musiman = Penjualan Bulanan / Penjualan Bulanan Rata-rata

Bagaimana cara memperbaikinya

- Sesuaikan rencana dan skema aktivasi dengan periode indeks tinggi

- Rencanakan frekuensi dan cakupan beat untuk menyesuaikan dengan peluang musiman

- Gunakan analisis prediktif untuk memperkirakan permintaan selama acara

Sub-KPI: Apa yang dimaksud dengan Tingkat Kanibalisasi?

Tingkat Kanibalisasi mengukur sejauh mana penjualan produk atau promosi baru menggantikan penjualan SKU yang sudah ada.

Mengapa Ini Penting

- Membantu mengevaluasi nilai inkremental yang sebenarnya dari inovasi

- Memastikan perluasan kategori tidak mengorbankan erosi internal

- Mendukung strategi ukuran paket, tingkat harga, atau varian yang lebih cerdas

Bagaimana Cara Mengukurnya

Tingkat Kanibalisasi = Penjualan yang Hilang dari SKU yang Ada / Total Penjualan SKU Baru

Bagaimana cara memperbaikinya

- Peluncuran paket dengan proposisi nilai atau tingkatan harga yang berbeda

- Pantau penurunan produk yang ada selama dorongan SKU baru

- Berikan insentif kepada perwakilan untuk melakukan penjualan ulang daripada mengganti

Bagaimana Sub KPI Ini Mendorong Indeks Pengembangan Pasar

Indeks musiman yang tinggi, jika dimanfaatkan dengan baik, akan meningkatkan total volume pasar pada periode-periode penting. Kanibalisasi yang rendah berarti pertumbuhan benar-benar bersifat aditif-bukan hanya pergeseran produk. Bersama-sama, keduanya membantu merek membangun momentum kategori yang nyata dan meningkatkan MDI.

Cara Mendorong Eksekusi dalam Skala Besar

- Menetapkan target pertumbuhan MDI khusus wilayah yang terkait dengan penjualan dan cakupan

- Gunakan acara lokal atau kalender musiman untuk waktu kampanye yang tepat

- Melacak peluncuran produk dengan kontrol untuk membatasi kanibalisasi

- Melatih perwakilan untuk melakukan segmentasi berdasarkan kematangan dan potensi pasar

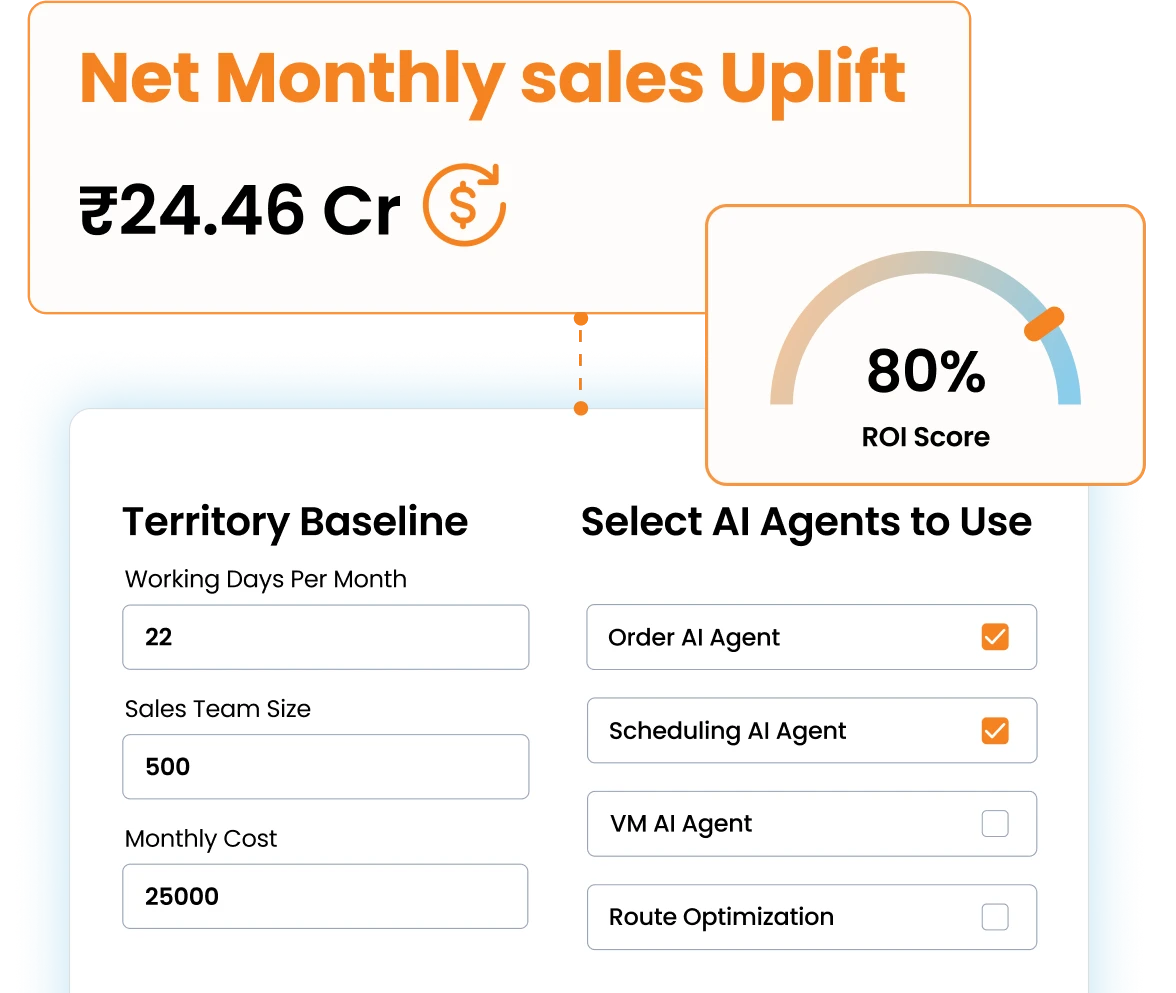

Bagaimana BeatRoute Dapat Membantu

Di sinilah kerangka kerja BeatRoute yang digerakkan oleh tujuan dari AI masuk.

- Menetapkan target terkait MDI per wilayah dan melacak jangkauan numerik, aktivasi outlet baru, dan kecepatan penjualan di zona yang kurang ditembus

- Memberdayakan tim lapangan dengan alur kerja AI yang bersifat agen yang memprioritaskan gerai-gerai berpeluang tinggi, memandu fokus musiman berdasarkan Indeks Musiman, dan memantau kinerja produk baru untuk mengelola Tingkat Kanibalisasi.

- Perilaku perluasan gamifikasi dengan memberikan penghargaan kepada tim yang telah mencapai cakupan gerai baru, mempertahankan kanibalisasi SKU yang minimal, dan secara efektif memanfaatkan peluang penjualan musiman.

- Memanfaatkan Kopilot BeatRoute untuk mengidentifikasi masalah-masalah yang melatarbelakangi rendahnya perkembangan pasar, baik di tingkat wilayah, tingkat perwakilan, maupun tingkat saluran.

Kesimpulan

Market Development Index adalah KPI strategis tingkat atas yang menandakan apakah Anda benar-benar memperluas jejak merek atau hanya meningkatkan pangsa pasar di kantong yang sama. Dengan memantau pendorongnya, merek dapat membuka pertumbuhan yang berkelanjutan dan ruang kosong.

KPI ini merupakan metrik eksekusi inti yang diakui di seluruh industri barang konsumen dan FMCG global. KPI ini digunakan secara luas untuk mengukur kinerja lapangan, dampak di tingkat gerai, dan efektivitas eksekusi penjualan. Melacak KPI ini membantu merek ritel menyelaraskan eksekusi lokal dan nasional dengan tujuan bisnis yang lebih luas seperti strategi pertumbuhan, perluasan pasar, dan profitabilitas.

Tentang Penulis

-

Kanika Agrawal owns deep first-hand market experience ranging from global corporations to startups, where she has contributed to building and scaling solutions that drive measurable business impact. She possesses strong expertise in AI and focuses on translating its capabilities into real business value.

Gunakan Goal-Driven AI untuk Mencapai Peningkatan Penjualan Ritel, Hari Ini!

Bergabunglah dengan perusahaan di lebih dari 20 negara yang mempercayai BeatRoute, platform AI yang dominan secara global untuk otomatisasi tenaga penjualan, penjualan lapangan, DMS, dan eB2B

Wawasan & Artikel Terbaru

Berikut ini adalah artikel, pembaruan platform, ebook, dan laporan yang paling berpengaruh untuk Anda.