What 2025 Has in Store for FMCG in Africa

Fast-Moving Consumer Goods or FMCG in Africa is a land of untapped potential, driven by recent urbanization, a rising middle class, and the consequently expanding consumer demand.

However, economic instability, infrastructural roadblocks, and fragmented distribution networks have always constrained the potential in this continent.

But there is good news as despite these drawbacks, the horizon looks promising for 2025 as FMCG in Africa gears up for immense growth, stimulated by emerging trends and new opportunitie

To that end, this article elucidates the transformative potential that 2025 holds for FMCG in Africa, drawing insights from our comprehensive FMCG Africa Outlook 2025 report, offering brands a roadmap to capitalize on the opportunities ahead.

Promising Trends for FMCG in Africa in 2025

- Elevating Consumer Demand

We are witnessing a growing consumer demand for FMCG in Africa, driven by a significant rise in disposable incomes and a youthful population increasingly exposed to global products.

According to sources like McKinsey & Company and The Brookings Institution, there is a considerable increase in consumer spending expected in Africa, projected to surpass $2 trillion in 2025.

- Dynamic Demographics

Rising middle-class populations and urbanisation are leading to both formal and informal retail expansion for FMCG in Africa.

- The Digital Shift

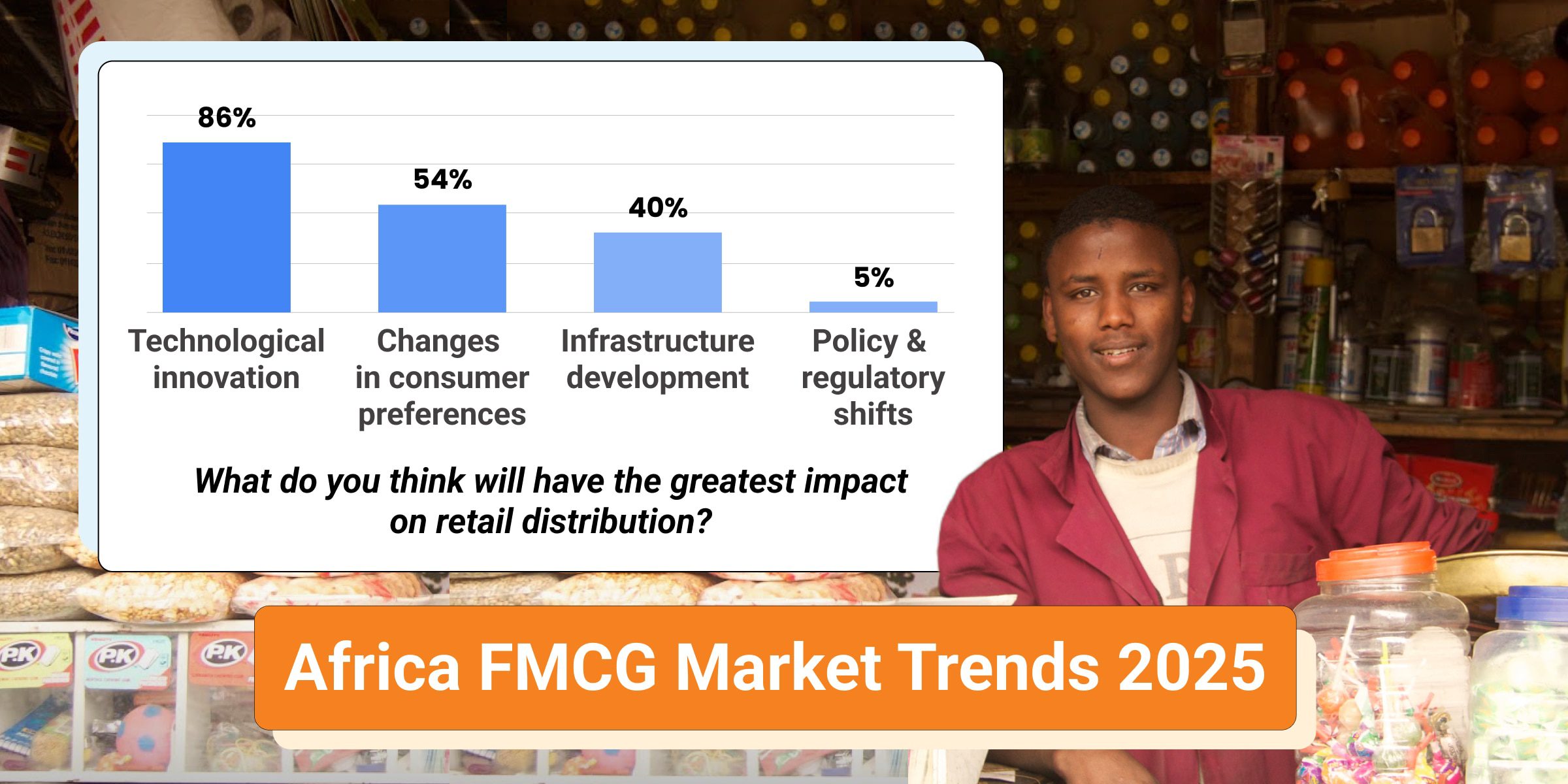

Tech adoption in Africa’s retail and distribution sector is increasing consistently. With internet penetration crossing 50% in several countries like South Africa (70%), digital platforms for retail and FMCG are becoming more mainstream every day.

Moreover, a high majority of FMCG leaders consider advancements to the supply chain as the top growth driver of 2025.

This opens doors to possibilities like the use of applications and tools to bolster field sales work and route to market activities.

- Urbanisation and Infrastructure

Countries like Nigeria and South Africa are witnessing major infrastructure developments. Improved road networks and urban development plans are set to alleviate supply chain challenges, enhancing logistics efficiency and boosting FMCG in Africa.

- Regional Trends

According to the United Nations Economic Commission for Africa,“…major African cities will house up to 85% of the continent’s population between 2010 and 2025”. With this as backdrop, East Africa continues to benefit from urbanization and the growth of modern trade, while West Africa lags in comparison but is gradually catching up.

- The Economic Factor

According to The African Development Bank Group, a 4.3% GDP growth is expected in 2025, signaling Africa’s potential as a leading region for economic expansion.

Resolving Africa’s Retail Challenges in 2025

- High RTM Costs – Africa’s vast geography and fragmented retail landscape lead to high logistics and distribution costs. Small, low-volume outlets are scattered across urban, semi-urban, and rural areas, making it expensive for brands operating in FMCG in Africa to reach them.

This is majorly due to reliance on manual processes or inefficient tools like Microsoft Excel, increasing errors and operational costs. They lack modern digital solutions that optimise their sales and distribution strategies.

Solution – Going digital helps brands to map their distribution network accurately using GPS, discarding manual inaccuracies. These tools help brands clean up data by preventing duplications and removing inactive stores from their lists. With this clean data available, route optimization software can create the most efficient routes to maximise productivity and sales.

- Informal Retailer/Distributor Operations – A major challenge in Central and West Africa is the informal distribution network, where wholesale traders and retailers stick to traditional practices and avoid adopting modern technologies. This creates barriers for FMCG brands in gathering valuable insights on demand and sales performance, which limits their ability to optimize their route-to-market strategies.

Solution – Overcoming resistance to new technologies is crucial. Embracing digital transformation through advanced tools for mapping, data cleansing, and route optimisation can significantly reduce operational costs, boost efficiency, and enhance service delivery.

- Digitisation Barriers – Many brands still depend on outdated and traditional methods like maintaining records on paper or spreadsheets. Resistance to change among distributors and smaller retailers hinders progress.

Moreover, FMCG brands may be cautious about adopting digital solutions due to concerns over slow ROI or unrealistic expectations. Additional challenges, such as skill gaps, high implementation costs, and limited internet access, further reduce the adoption of modern technologies, slowing down the digital transformation process across the industry.

Solution – Brands must invest in scalable and modular sales enablement platforms. Your sales system should be able to adapt to the growing business needs of brands and integrate seamlessly across sales, distribution and trade marketing functions, minimising costly replacements.

Training/educating distributors, retailers and sales teams about the benefits of digitisation is essential to overcoming resistance to change and fostering collaboration. Address skill gaps through continuous learning, ensuring that sales teams and channel partners have the technical expertise to leverage digital tools to their full potential.

Additionally, integrating digital systems introduces seamless data flow, eliminating information silos, mitigating errors, and providing a unified view of the route to market for effective retail execution.

- Lack of Cohesion Between RTM Stakeholders – The informal nature of Africa’s distribution network is also a hindrance to seamless trade as it results in inconsistent practices, information gaps, and limited to no transparency. As mentioned earlier, wholesale traders and retailers in Central and West Africa prefer traditional processes with manual efforts, resisting change.

There are also instances of payment delays and a lack of data sharing that lead to disputes and miscommunications. This strains the relationships between brands, distributors, and retailers, derailing route-to-market activities and harming sales.

Solution – Brands can develop joint business plans with distributors and retailers for goal alignment, clear expectations, and to identify growth opportunities like launching a product in new areas.

Digital tools offer enhanced visibility and transparency, hallmarks of trust. When distributors and retailers gain access to account statements and inventory, it minimises disputes and forms trust.

Implementing complaint management systems ensures grievances are not only quickly addressed, but that the process itself is transparent to encourage good service quality and accountability.

Sharing data-driven insights into sales patterns and opportunities helps partners optimize strategies and drive growth. In addition, training programs on digital tools and best practices empower your channel partners to operate more efficiently, encouraging the adoption of modern technologies for RTM success.

Conclusion

Each year brings new challenges and opportunities for FMCG in Africa. As we transition from 2024 to2025, the most noticeable challenge is tech adoption; traditionalists holding on to age-old-but-obsolete methods of carrying out retail distribution.

In today’s digital era, embracing digitization is not just an option—it’s essential for success. While traditional methods were once effective, leveraging technology alongside human effort is the path forward for achieving growth and efficiency.

While we have discussed how to inspire tech adoption, trends in the African FMCG market for 2025, existing challenges and how to resolve them, these are not enough.

There needs to be an universal awareness of why and how it matters to keep up with what’s happening, what could happen, and how to stay on top of things.

For that purpose, we have formulated the Africa FMCG Outlook 2025, a detailed report expanding on everything we have discussed here and more. Download your copy and get exclusive insights to revamp your FMCG RTM strategies for the future and beyond!

FAQs

What does it take to build a successful FMCG distribution network?

A successful FMCG distribution network in Africa requires digitizing outlet mapping, using route optimization to cut high RTM costs, and building stronger partnerships with distributors and retailers through data sharing and training. This combination improves reach, lowers costs, and drives sustainable growth.

How will FMCG companies manage rising costs and reduced consumer purchasing power in 2025?

FMCG in Africa will manage rising costs by using tools like BeatRoute to optimize routes, digitize outlet mapping, and improve retail execution. With real-time sales data and execution-linked insights, companies can cut logistics costs, and adapt quickly to shifting consumer demand.

What operational strategies will drive FMCG growth in Africa’s challenging 2025 economic environment?

FMCG in Africa, and specifically Nigeria, will rely on operational strategies such as route optimization to cut high RTM costs, digitized outlet mapping to clean up distribution data, and real-time retail execution tracking with platforms like BeatRoute. These approaches improve efficiency, reduce waste, and help brands adapt quickly to economic pressures.

About the Author

-

Apart from being a Senior Content Writer at BeatRoute, Soham is an avid reader of science fiction and suspense novels (Doyle, Christie, Brown or anybody great!) He also dabbles in historical narratives and wonders about our place in the universe. Cosmic viewpoints, Carl Sagan, and Neil deGrasse Tyson intrigues him. When not reading, you may find him spending his weekends or after-work hours watching a fulfilling movie with his family.

Use Goal-Driven AI to Achieve Retail Sales Uplift, Today!

Join enterprises in 20+ countries that trust BeatRoute, the globally dominant AI platform for sales force automation, field sales, DMS, and eB2B

Latest Insights & Articles

Here are the most impactful articles, platform updates, ebooks and reports for you.