Combining Placement, Demand Generation, and Liquidation for Agri-Inputs Route To Market

In the agri inputs industry, brands need to execute on three fronts to achieve their sales goals – placement, demand generation, and liquidation. Placement of products in the retail store, demand generation among end-customers/farmers, and liquidation where the farmer buys your products.

There is a very strong interconnection between these; placement without demand and vice versa is fruitless and as a consequence, your liquidation suffers. And each comes with its own challenges or dependency.

For example, if you have planned demand generation efforts in an area without knowing about the number or the profiles of farmers there or the ROI of the previous event there, you are not going to see a lot of return from such events. Either the number of farmers relevant to your offerings and aligning with the profile you are targeting will be too few and uncertain, or you will have invested in a community meet that has already proven its inefficacy in the past. Having the right data is crucial to making good decisions that help your business.

Similarly, if your sales officer or rep has no way to effectively track which distributors need immediate attention or has to remember different visit frequencies of numerous stores, he is going to make human errors almost inevitably. There will be no real concept of prioritisation in his visits and instead, he is going to end up over-or-under-engaging distributors or customers.

For liquidation too, where farmers are key, it’s a distillation of demand generation and placement efforts allowing farmers to be aware of your offerings and also find them when they need it. Therefore, when any one aspect – placement or demand generation – suffers, liquidation suffers.

You also have to keep an eye on factors like location, sales potential of the distributor/store, and the seasonality of your product to ensure minimal returns and maximum liquidation. For, in case of agri inputs, not every pesticide or fertiliser will be applicable to all crops, especially when different crops favour different times of the year and precise windows in their growth process. Place too many or too few products at a store and there will be as many returns or missed opportunities.

To reiterate – you harness all three (placement, demand generation, liquidation) together or it’s pointless.

The Problems with Route To Market in the Agri Inputs Industry

Much like in other industries, a brand in the agri inputs industry is dependent on every member of its route to market to function optimally to achieve its goals. From placing your products at distributors who in turn place them at retailers to farmers buying from retailers or distributors or even directly from you (such as farm owners), there are a lot of moving parts that need to be managed. Sales reps or sales officers do this and the first step to managing their routes or distributors is to have ready, actionable data at their fingertips. This not only facilitates great engagement but also quick resolutions to roadblocks.

Data is an overarching concept here that affects a wide range of activities from visit frequencies to productive visits at the distributor’s to scheme communication to competitor presence at retailer’s to payment collection to marketing events. Without a system to properly decipher and organise data to then suggest actions, your business will never really function at its full potential because your liquidation will never be up to the mark.

Issues That Lead to Inadequate Placement

- Consider the scenario where sales officers cannot visit the right distributor/store at the right time or frequency or that brands don’t have data to understand what their field agents are doing or how productive they have been to re-strategise if necessary. This can mean problems with placement, trade promotion efficacy, issue resolution and more.

To clarify, without a system in place to track and interpret data, sales officers are forced to commit visit frequencies of numerous distributors and retailers to memory. They must also figure out for themselves the best routes to maximise productivity. Add to this a cumbersome issue resolution process and credit-related problems and they are bound to miss things and make mistakes, derailing your route to market. For a brand, a lack of on-ground information, such as the number of relevant distributor onboardings, productive visits (accomplishing the purpose of a visit), visit frequency adherence, scheme success, competitor presence in retail stores, etc., is a major red flag. - Your salespersons have to remember every product combination or schemes associated with these products. The schemes may be in dozens or more and fluctuating with time. This is a very tough task if not downright impossible. A lack of knowledge here means that sales officers may end up pushing incorrect schemes for that particular distributor/customer or fail to push schemes at all. All of this severely reduces the potency of schemes that are designed specifically to drive more products to distributors and ultimately, lead to placements. And this means potentially lower liquidations.

- A lack of distributor visibility into sales targets, accumulated points, and scheme details is also detrimental to product placement at retailers. Why? Because distributors who can’t see these things clearly won’t be motivated to buy more from you, push your products or meet their sales targets. Therefore, it’s not enough to design and plan great schemes or incentives, you must also ensure that your stakeholders know about them.

- Due to the return-if unsold model, distributors are always wary of opening boxes that they deem unnecessary. For example, if the distributor opens up a 100-item box and sells about 20 items at the first go and then due to unforeseen circumstances like a pandemic or failed rains or farmer protest, the remaining 80 are unsold, the distributor will be incurring a tremendous loss. For this reason, distributors are hesitant to open a box when they are in doubt about actual demand or other conditions that they deem detrimental to secondary sales. There are even situations where if a retailer requests a small batch of items, the distributor simply refuses, claiming a lack of supply. They know that returning unopened boxes will allow them to avoid losses. This leads to underselling and missed opportunities for brands who get more returns than expected.

- When sales officers visit distributors for payments, they often come across an obstacle wherein distributors refuse payment because they weren’t given any acknowledgement about their last payment. This makes them unwilling towards further transactions because they don’t have any visibility into their previous transactions that something like a statement of account could provide. Resolving confusion on this scale eats up a lot of time and opportunities.

- Competitor analysis is crucial because it gives you room to manoeuvre to counteract competitor strategies that aim to establish market dominance. Your sales officers visit retail stores to check out what the competitor has been doing but without a system to record this information, such as taking pictures or maybe a video or even text, the effort is largely wasted.

- As in any business, distributors prefer to put their trust in established and proven brands. With a “return if unsold” model, distributors find it imperative to associate with brands whose boxes when opened would assure maximum sales. Naturally, if yours is a new brand or a brand that is trying to penetrate a specific market segment, you won’t have historical data and as such would be behind your competitors without taking certain measures.

- As with any business, issues are bound to occur. When a sales officer talks to a distributor and reports the issue to their manager via phone or personally, that’s usually the end of their knowledge about what’s happening with the escalation. The issue ticket travels from one level to another until it reaches the people responsible for resolving it. There is no track or update for the sales officer to communicate to the distributor the next time they talk and the distributor remains in the dark, concerned until it’s finally resolved. As expected, this is more a matter of transparency than TAT; distributors and even sales officers are unaware about the status of their issues, leading to lost opportunities, arguments, and dissatisfaction. Understandably, product placements in retail stores also take a hit here.

Issues that Lead to Suboptimal Demand Generation

- Agri chemists, with their important role of converting farmers to paying consumers or customers in case of B2B transactions, are generating demand for your products. There are a couple of issues they face while doing their jobs:

- They need to map farmers based on specific profiles that take into account acreage and crop preferences. They can’t do this accurately without a system to add the farmer information, making the whole thing analogue and unreliable.

- Without a structured way of capturing information such as farmers who attended village-level awareness meets or spot demos, there is no way to analyse if such events are successful. The ROI remains unclear because it is near-impossible to gauge the percentage of farmers who were converted and how much business they brought in.

- Marketing executives are responsible for capturing seasonal demand among farmers for your products. One of the ways they do this is via town/village meets for farmers to come and be educated on your offerings. Without a system for capturing data, the downsides are glaring:

- There is no way to improve or re-strategise for future meets due to a lack of historical data on past events

- There is no way to measure event outcome or success because your ROI is incalculable without knowing the extent of business uplift from the event, i.e. how many farmers were converted because of the event and their profiles (since this will tell us the products that they will buy and the ticket size)

- Farm owners tend to buy their agri inputs products from more than one brand. If your sales reps are not aware or educated about product launches and the USP of your products or lucrative schemes, it becomes an uphill task to consistently and effectively push your products to these B2B customers and keep them loyal to you.

- Considering the seasonal aspect of the agri inputs industry, brands need to hire a lot of temporary personnel for spot demos and marketing activities. The issue that can happen here is that getting trained on products and on-field technology like an app can take up a lot of time. Time that the brand doesn’t have in the small window it has to get farmers to purchase from it.

The Factors Behind Failed Liquidation

- In the agri inputs industry, products are placed in retail stores or at a distributor’s on credit, meaning what’s not sold gets returned to you. With the products being seasonal, there isn’t much room for a redo in case liquidation doesn’t go according to plan. For lack of a system or software that allows sales officers or agri chemists to reliably record liquidation or sellout, there remains a gap in timely communication and also the authenticity of reports. The downside here is overstocking or miscalculated placements, leading to eventual returns and therefore, major losses for brands.

- Any optimal farmer engagement always happens before the advent of a crop season to prepare farmers to buy your offerings as soon as your products are placed at the distributors. For this, numerous measures such as spot demos or community meets need to be set up and executed to convince farmers why they are the finest choice in the market. Any insufficiency in this regard may well translate into inadequate liquidation because farmers will only buy products or from brands they are familiar with.

- With demand generation done and farmers poised to purchase your products, limited period offers or special discounts or the fact that your products are ready at retailers’ for purchase or some other urgent information must be communicated to farmers with haste. This is meant to give your liquidation efforts that extra push. Tactical marketing happens in-season and is focused wholly on offtake.

- It is critical for liquidation that marketing and sales teams closely collaborate. Without accurate and timely information from the sales team, marketing resources may be misallocated in areas where distributors haven’t yet been stocked or haven’t placed your products in retail stores. Similarly, if agri chemists don’t pass on information to the sales people about the time of product application, it will be hard to inspire distributors to stock up on your products or sufficiently place them at retail stores.

Before we move into the solutions aspect of this piece, let us re-emphasise the interdependency of placements, demand generation, and liquidation. Apart from what we have already discussed, it is important to note that distributors are unwilling to place your product at the retailer’s unless they are convinced of your demand generation efforts. Without a systemised approach, it is not possible for sales officers to monitor the status of activities or determine if marketing executives are productive enough. A lack of activity tracking on this scale fails to satisfy your distributors enough and your product placements and liquidation suffer.

Running a Successful Route To Market in the Agri Inputs Industry

By working with leading brands in the agri-inputs industry over the years, we have not only developed a thorough understanding of the challenges faced by brands, but also developed deep capabilities to help them resolve those challenges.

Let us explore how those challenges can be solved using our platform capabilities for illustration.

Drive Optimum Placement at Retail Outlets

Ensure Visits Are Prioritised According to Business Needs

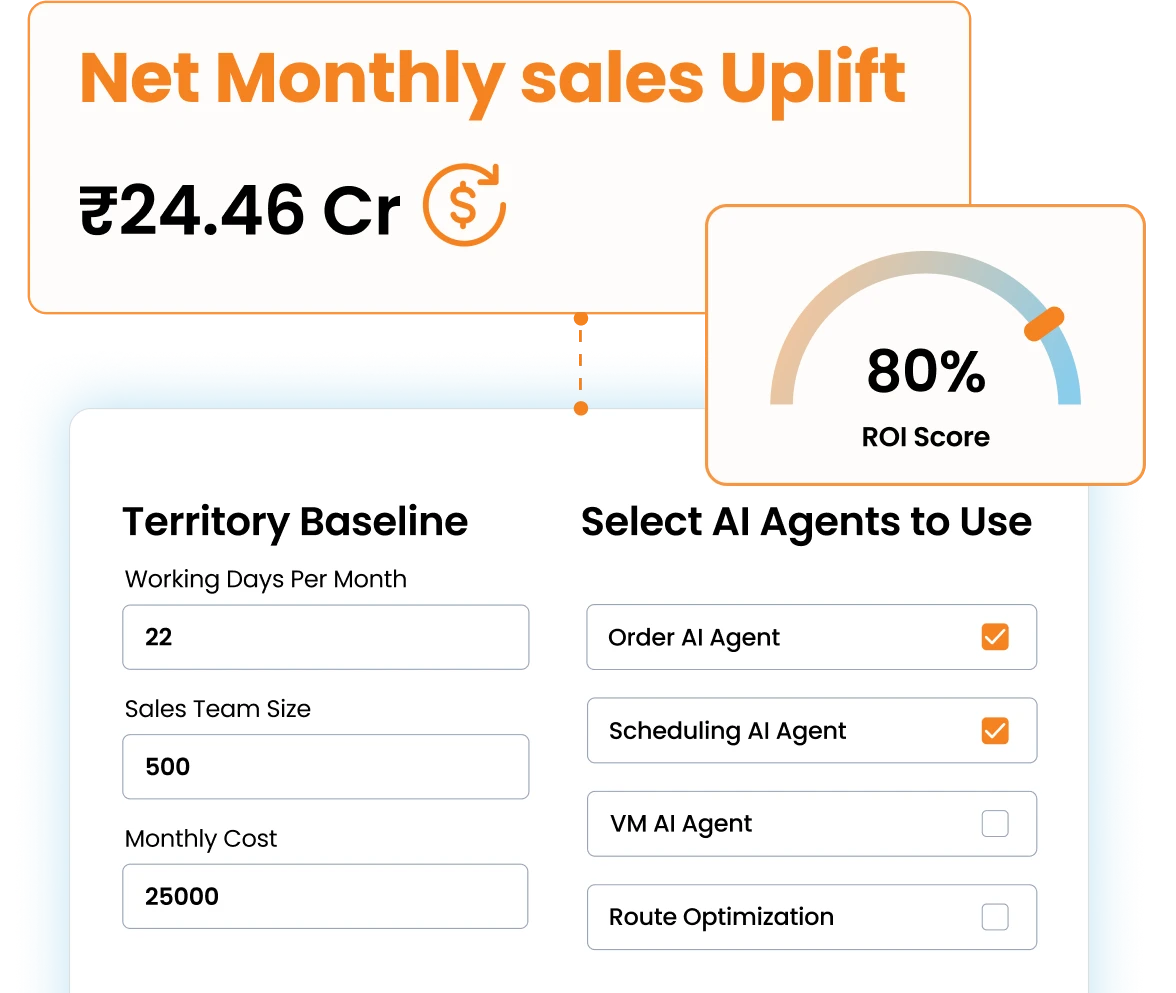

With a reliable enterprise level sales app, visit frequencies and routes need not be a matter of remembering anymore. Such information is readily available and bolstered by AI suggestions for store visits to save time and energy while your sales team focuses on order taking and engaging distributors/customers. Data is not simply gathered and open to interpretation anymore, but salespersons are actually advised on how to act on it.

Our customers have been using our platform to figure out where visit frequencies have been just right, where course correction is necessary, and the productivity of visits (or the lack thereof).

Leverage Operational AI for Order Taking

A typical agri-inputs brand has hundreds of SKUs. When the sales officers go to the retailers for order taking, they have to make a subjective decision on which SKUs to pitch to each retailer. This subjective decision causes a lot of issues with placement wherein some incorrect SKUs are placed, and some correct SKUs are missed.

At the same time, order taking itself is a tedious process, wherein the sales officer has to remember which SKUs the retailer typically buys, enter that data manually. On top of that, there are a large number of schemes which might be running at the same time. Recalling and pitching the right scheme for each retailer itself is a daunting task, leading to scheme utilisation typically hovering around 50-60% only.

Our customers use our AI Order Recommendation workflow to build a readymade basket depending on each retailer’s typical ordering pattern, suggest new SKUs which similar retailers are buying, and call out the relevant schemes which are available for that retailer. This not only saves sales officer’s time, but also ensures the placement of ideal SKUs and proper utilisation of currently running schemes.

Develop In-store Situational Awareness

Brands that have data on what’s happening inside a retail store in terms of placement and offtake are better equipped to handle placement issues. For example, if a salesperson visits a retail store and documents that there isn’t enough inventory to meet tertiary sales demand, the brand can then discuss with the distributor and persuade them to place more inventory at these stores. This can be in the form of special discounts during primary sales or by encouraging more retailers to order from that specific distributor, leading to more secondary sales and fewer returns.

Similarly, It is very important for new brands or brands with a new product competing with already established entities in the market to have a clear idea of what retailers and distributors think of them. Initial pushback or rejection from distributors is understandable because you or what you are offering is still largely unproven.

But if you are able to gather their feedback and analyse their key objections, you will have eyes on what’s not working, what your competitors are doing better, distributor expectations and what to modify (if needed), to recalibrate your strategy to fulfil your placement goals.

Empower Your Distributors and Retailers

You can turn your distributors and retailers into business collaborators by educating them on your products, letting them know about your schemes which are available to them and making it easier for them to place orders to you.

BeatRoute provides your B2B customers easy access and easy adoption via WhatsApp/Viber authentication and the advantage for you here is that everyone is on WhatsApp or Viber these days. Therefore, without a need to install a brand new app in a sea of apps on their phones, distributors can easily access orders and reward points via WhatsApp/Viber. To be able to order when necessary, to be able to have full visibility on schemes, and to be able to check out accumulated reward points and future milestones creates a drive in distributors to buy more and place at retail stores ASAP.

Make Customers Happy with Transparent Payments

Payment overdues are not good for business because you are not getting paid for your products and your distributor won’t be able to place further orders if their overdue takes them beyond the credit limit. It is in your interest to resolve this and one of the easiest yet effective ways of doing this is providing regular statements of account to your distributor or customer. Give them a clear picture of their transactions, available credit, and any pending payment through WhatsApp alerts or B2B Customer App.

Carry Out Competitor Analysis to Stay Relevant

Recording and analysing competitor activities at a retail store or distributor’s is a massive game changer when done right. When your sales team has the ability to utilise multimedia capabilities such as images, videos, and text to record competitors’ presence, placements, and merchandising efforts at a retailer’s or distributor’s, you get an excellent opportunity to recalibrate your current strategy and stay ahead in the game.

Make Issue Resolution a Transparent Process

It is important to follow a reliable and visible structure during issue resolution. Typically, the distributor informs the sales officer of a problem, the sales officer informs their manager about it, and this gets escalated further on until it reaches the right department. When done manually, any updates on the issue such as at what stage of the resolution process it’s in currently, has to travel down the same chain before it reaches the sales officer and the distributor. At BeatRoute, our Freshdesk integration provides real-time updates on any issue submitted by the sales team or the retailer. This not only allows for tracking issues but also to capture said issues efficiently and for structured follow-ups, ergo, eliminating uncertainty and boosting customer satisfaction via complete visibility.

Generate Demand in Sync with Placement

Build Data Drive Profile of Your Farmers

A dependable system for mapping farmers would allow salespersons to capture and update details on the go and on a mobile device. If an agri chemist meets farmers in a new area, talks to them and notes down their details on a piece of paper or a digital note, that note can get misplaced or deleted. As a result, all data related to mapping the aforementioned farmers’ would be lost and any business expected from that interaction would not happen. With a digital system like BeatRoute, these farmers can be segmented into different profiles based on acreage and crop preferences and the captured data will be organised and easily accessible for future reference.

Run & Execute Community Meets with Focus on ROI

Community meets are organised with the purposes of making farmers aware about your brand and educating them about your offerings. To convert them into end-customers is to bring in more business. Spot demos by agri chemists that deliver a practical demonstration of a product’s capabilities over days/weeks or bigger community events by marketing executives who verbally explain what you are offering to farmers necessitate the capture of data. A system allows this and what this does is give you a clear picture of the expenses, farmers that attended, and relevant farmers who were converted – a clear understanding of your business uplift from an event. A clear view of your ROI from community meets and events allows you to plan again, change what’s not working, and make the next event even better.

You may suddenly notice that some of the farmers that used to buy your products on a seasonal basis have stopped doing so. These community meets and spot demos give you a great avenue to re-engage such farmers and bring them back to you.

Participation Tracking with BeatRoute

BeatRoute enables your marketing executives or agri chemists to track participation (how many farmers attended, which farmers) from events and demos. Evidently, this is a big help when it comes to measuring how successful or unsuccessful such events are because you also get to document the number of farmer conversions, indicating the business to come. A sales team that is not enabled with such a tool would find it extremely difficult to track anything accurately from community events. Being able to calculate your ROI provides you deep insight into where course correction is necessary and where you are already on point.

Educate Your Sales Team & Customers About Your Products

The first criterion to convince distributors to stock your products or skus is to know about the products yourself. For your salesperson engaging distributors/customers for the first time or maybe about a brand new product launch, it is immeasurably helpful when they not only know the features but also the USP of said product. This is especially true for B2B customers in the agri inputs space, the farm owners, who buy from multiple brands, whichever suits their needs. In such a competitive scenario, staying on top of what your customer wants and to communicate your offerings consistently and effectively is paramount to doing successful business. The BeatRoute sales app allows your sales reps access to educational videos regarding your products, new launches, changes, etc., so that they are able to answer every question with clarity and precision. At the same time, you can educate your retailers and distributors digitally with our B2B Customer App.

Make It Easy For Your Seasonal Staff to Hit the Ground Running

The need for temporary personnel to handle seasonal demand generation and marketing activities in the agri inputs industry cannot be overstated. To support such a staff, it is incredibly helpful to have a user-friendly system that has all the relevant campaign forms, learning materials, and product information on it. The marketing person can simply refer to it to perform most of his duties with ease instead of going through a learning curve that’s detrimental to the brand.

Foster Collaboration Between Your Sales and Marketing Teams

Sales and marketing are crucial departments for your route to market efforts and their collaborative efforts is what finally leads to effective liquidation. A system that enables your sales team to co-work with, say, an agri chemist, is invaluable because this eliminates delays. The sales officer can set up a demand generation plan (such as demos or community events) in areas where they deem it necessary and the events would be assigned to the right agri-chemist or marketing executives. While such collaboration allows marketing to operate in areas where retail stores are well-stocked, working closely with agri chemists also allows sales teams to more effectively convince distributors to execute more placements, leading to more liquidation.

Run Efficient Liquidation Within a Narrow Time Window

Gather Data to Track Liquidation

Sales officers and agri chemists document liquidation or sellout and this data is important to ensure timely corrective action if liquidation is slow or insufficient. With a system in place, such data can be recorded and immediately sent up the hierarchical chain to the concerned person(s) who can take a prompt decision on how to improve liquidation. Tactical marketing or promotions can help or maybe there is a need to talk to the distributor regarding understocking at the retailer’s. Short liquidation windows in the agri inputs industry necessitate structured data gathering and communication for fast resolutions.

Put Systems in Place for Effective Tactical Marketing When Needed

Tactical marketing provides a boost to your sales efforts by offering discounts or information with a dose of urgency during the liquidation window. A reliable system that keeps this information easily accessible to marketing executives ensures that they are able to do their job efficiently. Liquidation-focused tactical offers are also visible or communicated to distributors and retailers via their web apps. At the same time, the on-ground marketing team is able to track any mass marketing activities and assess their ROI as well, information that is crucial to further efforts.

Engage Farmers More Effectively

Effective liquidation and minimal returns means to ensure all demand generation activities such as spot demos and community meets are carried out before the start of the crop season. A reliable app for agri chemists or marketing executives ensures that product information is readily available at their fingertips and that they are able to accurately record the data to help you measure the ROI from such events. Successful events ensure that you capture the attention of farmers who only buy from brands they know or trust.

Here’s What We Conclude

There are three pillars for the agri-inputs industry route to market – placement, demand generation, and liquidation. Many look at these as isolated and separate processes, necessitating separate efforts. But we assert that there is a need to combine these three together to ensure a genuinely successful route to market. In this article, we have described how our customers in the agri-inputs industry use our platform to execute optimum placement, generate intended demand and drive timely liquidation to achieve their sales goals.

If you would like to see our platform in action, and see how we can help you with your route-to-market, you can request a free demo here.

About the Author

-

Apart from being a Senior Content Writer at BeatRoute, Soham is an avid reader of science fiction and suspense novels (Doyle, Christie, Brown or anybody great!) He also dabbles in historical narratives and wonders about our place in the universe. Cosmic viewpoints, Carl Sagan, and Neil deGrasse Tyson intrigues him. When not reading, you may find him spending his weekends or after-work hours watching a fulfilling movie with his family.

Use Goal-Driven AI to Achieve Retail Sales Uplift, Today!

Join enterprises in 20+ countries that trust BeatRoute, the globally dominant AI platform for sales force automation, field sales, DMS, and eB2B

Latest Insights & Articles

Here are the most impactful articles, platform updates, ebooks and reports for you.