What is a Statement of Account? Meaning, Format, and Importance for Distributors

A Statement of Account (SOA) is a vital financial document that provides a detailed summary of all transactions between a brand and a distributor. In the FMCG and consumer goods industry, SOAs are not just about tracking money – they help distributors and suppliers maintain financial transparency, speed up collections, and avoid disputes.

This guide explains what a Statement of Account is, why it matters in distribution-driven businesses, and how to make the most of it using sales tech.

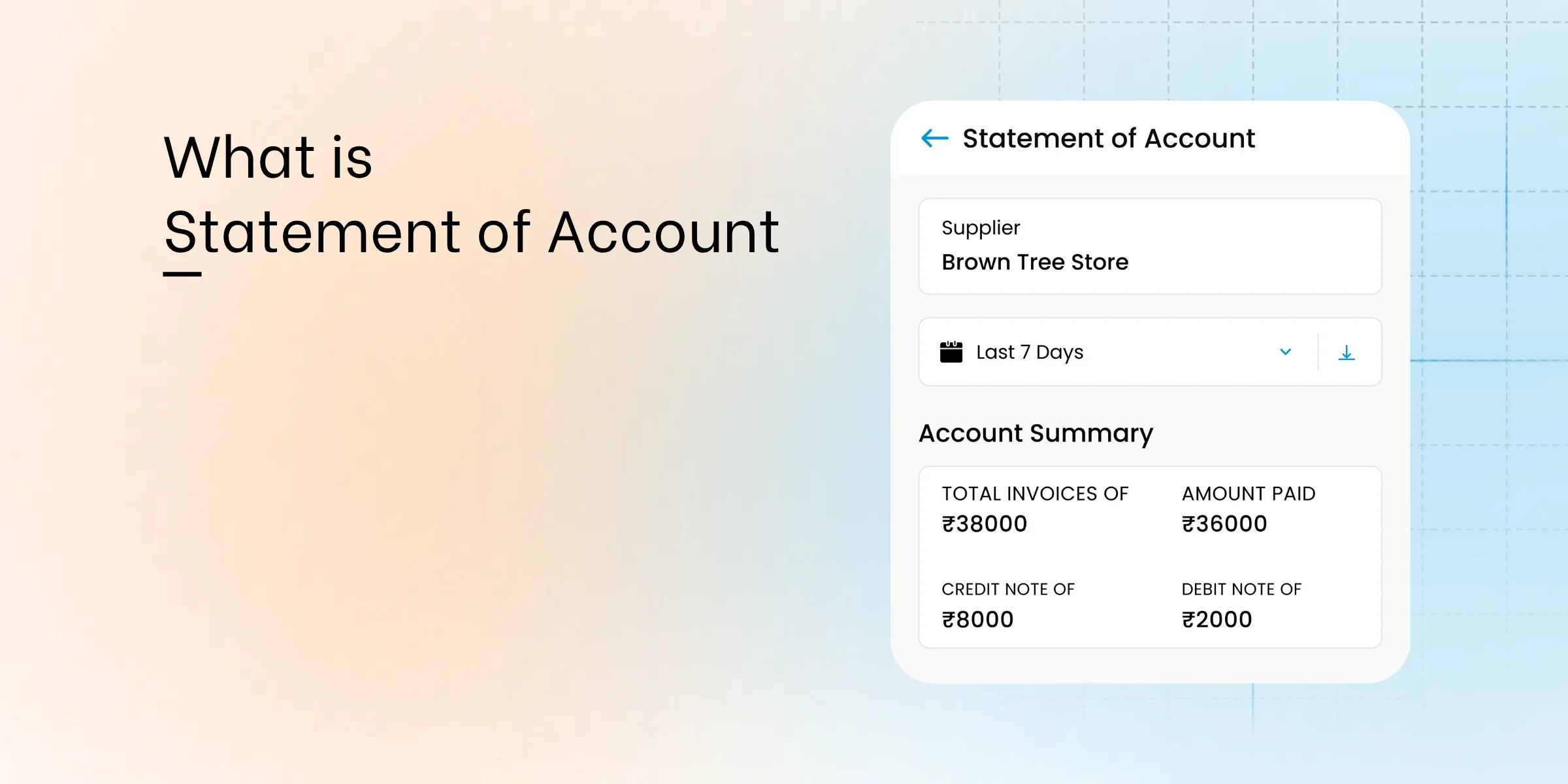

What is a Statement of Account?

A Statement of Account is a document generated by a brand or supplier that shows the complete record of invoices, payments received, credits issued, and outstanding balances for a distributor. It offers a consolidated view of the financial relationship over a given period.

Why Statements of Account is Important

Distributors manage thousands of transactions every month. A well-maintained SOA helps:

- Track outstanding payments and credit settlements

- Resolve invoice disputes faster

- Bring financial clarity between brand and channel partner

- Speed up the reconciliation process during monthly or quarterly closings

Who Uses SOAs the Most?

While SOAs are issued by brands, they are used heavily by:

- Distributors and stockists to stay updated on receivables

- Finance teams for reconciling payments and claims

- Field sales reps to answer retailer queries in real time

What Should a Statement of Account Include?

A distributor-focused SOA typically lists:

- Invoice numbers and billing dates

- Product details and quantities

- Unit prices, discounts, and applicable schemes

- Payments received and current balance

- Any credit notes issued for returns or adjustments

Real-World Use Cases for Statements of Account

1. Secondary Sales Reconciliation

Distributors use SOAs to match what brands have billed against their own supply records, helping prevent disputes before they escalate.

2. Scheme and Offer Validation

SOAs serve as the reference point for checking whether promised trade schemes and credit notes have been issued and accurately reflected.

3. Monthly Closings

During financial review cycles, the SOA is used to reconcile books between distributor and brand accounts, ensuring closing accuracy.

4. Escalation and Dispute Resolution

When there’s a mismatch in understanding between the brand and distributor, SOAs serve as the first shared document to investigate the issue.

How Technology Improves Statement of Account Management

Modern sales and distribution platforms help brands and distributors manage SOAs more effectively by:

- Auto-generating SOAs after every billing cycle

For example, once a distributor’s claim or invoice is processed, the system automatically adds it to their live SOA, keeping them updated without manual follow-ups. - Making SOAs accessible via mobile apps for field and distributor teams

Example: A field rep visiting a distributor in a remote location can pull up the latest SOA on their app to resolve a payment query on the spot. - Highlighting mismatches and disputes instantly

For instance, if a credit note hasn’t been accounted for in the distributor’s SOA, it’s flagged immediately so the brand team can take action before it escalates. - Linking SOA views to scheme eligibility and beat-level activities

Example: If a distributor hasn’t met scheme criteria due to delayed payments, the SOA section shows real-time ineligibility to help the field team address it proactively during the beat.

Modern sales and distribution platforms help brands and distributors manage SOAs more effectively by:

- Auto-generating SOAs after every billing cycle

For example, once a distributor’s claim or invoice is processed, the system automatically adds it to their live SOA, keeping them updated without manual follow-ups. - Making SOAs accessible via mobile apps for field and distributor teams

Example: A field rep visiting a distributor in a remote location can pull up the latest SOA on their app to resolve a payment query on the spot. - Highlighting mismatches and disputes instantly

For instance, if a credit note hasn’t been accounted for in the distributor’s SOA, it’s flagged immediately so the brand team can take action before it escalates. - Linking SOA views to scheme eligibility and beat-level activities

Example: If a distributor hasn’t met scheme criteria due to delayed payments, the SOA section shows real-time ineligibility to help the field team address it proactively during the beat.

Final Thoughts

If you’re a distributor-driven brand, a Statement of Account isn’t just a financial formality – it’s a powerful tool for transparency, faster collections, and trust-building. When managed with tech, it can help automate financial workflows, reduce manual errors, and keep your channel partners aligned.

Book a demo to discover how we streamline Statement of Account tracking and reconciliation for FMCG distribution.

About the Author

-

Surya Panicker is the Head of Content at BeatRoute, where she leads content strategy for India’s goal-driven sales platform. With 9 years in marketing automation and SaaS, Surya specializes in building content that translates complex solutions into actionable business outcomes. Her approach combines data-driven insights with a storytelling mindset, always putting the customer at the center of her narratives. Surya focuses on aligning brand messaging with audience needs to deliver practical results. Outside of work, she enjoys exploring new cuisines, reading fiction, and traveling with her family.

Use Goal-Driven AI to Achieve Retail Sales Uplift, Today!

Join enterprises in 20+ countries that trust BeatRoute, the globally dominant AI platform for sales force automation, field sales, DMS, and eB2B

Latest Insights & Articles

Here are the most impactful articles, platform updates, ebooks and reports for you.