India FMCG Industry Outlook 2025

India’s Fast-Moving Consumer Goods (FMCG) industry is more than just a commercial engine—it’s a socioeconomic force. From daily essentials to job creation, the sector contributes significantly to the nation’s GDP and employment base. Yet, with evolving distribution models, the rise of digital commerce, and macroeconomic volatility, 2025 presents both a challenge and an opportunity for FMCG players.

In the “India FMCG Outlook 2025,” BeatRoute surveyed over 100 senior professionals across the FMCG sector to understand how companies are planning to adapt. The insights reflect a sector in transition, navigating growth, digital disruption, and operational realignment.

Optimism with Caution: The 2025 Growth Forecast

According to the report, 43% of FMCG leaders anticipate faster growth in 2025 compared to 2024, while 27% expect a similar trajectory. However, 30% foresee slowed or negative growth.

What this means: Growth is not monolithic. Instead, it varies sharply based on region, category, and consumer profile. Premium organic foods and skincare are booming in metros,

“Let’s just say that the growth graph in FMCG isn’t a straight line—it’s full of twists, turns, and some loop-de-loops.”

Four Growth Catalysts to Watch

1. Rural and Semi-Urban Expansion (56%)

FMCG brands are increasingly looking beyond metros. Tier 2/3 towns and rural pockets offer untapped potential, driven by rising income and mobile penetration.

2. Rise of Q-Commerce and E-commerce (51%)

The demand for instant delivery is redefining how goods move. Q-commerce is now seen as an indispensable growth engine, connecting brands directly to consumers, often with kirana stores acting as hyperlocal fulfillment nodes.

3. Supply Chain Digitization (48%)

AI, SFA, and DMS tools are enabling brands to streamline their route-to-market (RTM) operations. This shift isn’t just about efficiency—it’s about real-time adaptability.

4. Product Premiumization (45%)

Affluent consumers are willing to pay more for differentiated experiences. Think: Nestlé’s Espresso Concentrate or bespoke personal care lines designed for urban millennials.

Navigating the Headwinds

Rising Costs and Economic Uncertainty

63% of respondents identified raw material inflation as their top concern. Meanwhile, 36% cited macroeconomic unpredictability as a hurdle to forecasting and planning.

Channel Conflict and Competitive Intensity

As eB2B models and Q-commerce evolve, traditional distributors feel sidelined. 42% of leaders noted friction with existing stakeholders, while 49% mentioned intensified competition.

Strategic Responses: From Conflict to Collaboration

Digital Collaboration with Distributors

Instead of bypassing traditional partners, brands are bringing them into the digital fold via in-house B2B apps and loyalty programs.

Empowering Sales Managers with AI

By using AI for visit planning, task allocation, and execution diagnostics, frontline managers are shifting from reactive to proactive roles.

Strengthening Data Foundations

Fragmented, inaccurate, or delayed data continues to plague execution. In 2025, 40% of respondents are prioritizing unified platforms (integrating SFA, DMS, and Retailer Apps) to build real-time, actionable insights.

Kiranas in the Q-Commerce Era: Adapting, Not Vanishing

Despite speculation, kirana stores remain vital. They account for 85-90% of FMCG sales. According to the report:

- 60% believe Q-commerce will not significantly harm kiranas.

- 16% believe it will enhance demand.

What Brands Are Doing:

Brands are taking a partnership-driven approach to ensure kiranas thrive in this new era. They are enabling these neighborhood stores with retailer-focused digital apps for inventory and scheme management, providing co-branded fulfillment support to streamline logistics, and offering targeted in-store promotions and schemes. This approach helps kiranas stay relevant, competitive, and better integrated with broader FMCG strategies.

The eB2B Platform Pivot

71% of leaders believe third-party marketplaces will play a minimal role moving forward, while 62% vouch to building their own in-house eB2B channels.

Creating proprietary eB2B platforms gives brands greater control over retailer relationships and transaction data. It allows for personalized schemes, direct communication, and seamless integration with field sales activities. This strategic pivot is about safeguarding long-term value and reducing dependency on external platforms with unpredictable agendas.

AI as a Strategic Growth Lever

Key Applications Identified:

- Sales team productivity (+58%)

- Product launch success (+52%)

- Partner engagement (+53%)

- Territory management (+36%)

AI is being used to identify sales opportunities, optimize stock levels, recommend SKUs, and even provide real-time, natural language insights through conversational tools. It’s becoming an operational co-pilot for sales reps and managers alike.

2025 Priority Areas for FMCG Brands

- Integrated Data Platforms (40%) Organizations are prioritizing the development of systems that unify sales, distribution, and retail engagement. These platforms eliminate data silos and enable smarter decision-making across teams.

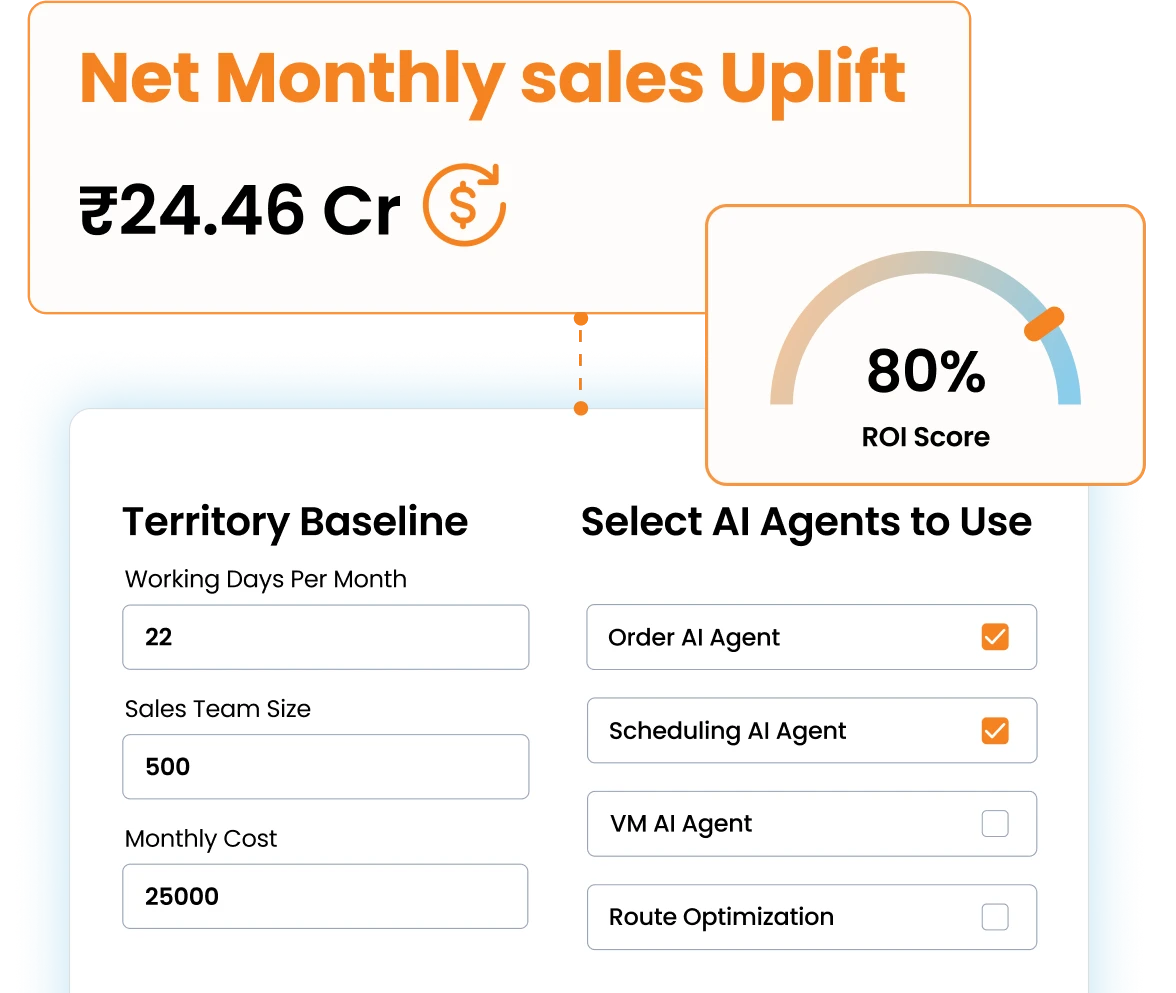

- AI Adoption (27%) AI is no longer in the experimental phase. Brands are seeking tangible ROI through smarter planning, better execution, and predictive analytics that enhance market responsiveness.

- Building a Data Lake (14%) As analytics becomes a core competitive advantage, data lakes offer the foundation for scalable, future-ready insights across functions and geographies.

- eB2B Expansion (10%) Brands are moving fast to reclaim control from third-party marketplaces, developing direct-to-retailer platforms that support scalable and transparent distribution.

- D2C Channels (9%) Direct-to-consumer is emerging as a complementary channel for building brand affinity, gathering customer intelligence, and enabling tailored engagement strategies.

Final Takeaways

- Unify Your Platform: Break silos between sales, distribution, and retailer engagement through an integrated tech stack.

- Digitize Relationships: Empower channel partners with tools that support ordering, promotions, and engagement.

- Use AI Smartly: Focus on real, actionable use cases like visit planning, order recommendations, and intelligent insights.

- Retain Control: Build your own digital infrastructure—such as eB2B—to stay agile, scalable, and brand-aligned.

Use Goal-Driven AI to Achieve Retail Sales Uplift, Today!

Join enterprises in 20+ countries that trust BeatRoute, the globally dominant AI platform for sales force automation, field sales, DMS, and eB2B

Latest Ebooks & Reports

Download these free reports & ebooks to prepare your brands for future-ready route to market.