Customer Profitability KPI

Customer Profitability is a key metric that shows how much actual profit a consumer goods brand earns from each customer, after subtracting the cost to serve them. It highlights whether a brand’s field efforts and servicing model are generating sustainable financial returns, not just top-line sales.

For consumer goods brands that operate in diverse territories with varied customer profiles, Customer Profitability helps distinguish between high potential and high cost customers, guiding smarter execution.

Why It Is Important for Retail Brands to Track It

Customer Profitability enables:

- Better allocation of time, discounts, and attention to profitable customer segments

- Smarter decision-making in product mix, servicing frequency, and promotional support

- Reduction in revenue leakage from low-margin or high-cost customers

- Strategic focus on long-term value instead of short-term volume wins

By tracking it consistently, brands can avoid inefficiencies and scale high return customer relationships.

How to Measure Customer Profitability

Customer Profitability = Total Revenue from a Customer – Total Cost to Serve that Customer

Costs include everything from logistics and field servicing to discounts, schemes, and sales time.

Example: If a customer generates $1,500 in revenue but costs $1,100 to serve, profit is $400.

Brands may use this KPI monthly or quarterly to segment customers by contribution tier and guide territory level execution.

What Drives Customer Profitability?

To improve this KPI, consumer brands rely on these two powerful sub-KPIs:

- AOV (Average Order Value): Revenue per transaction

- Average Sales per Customer: Revenue per customer over time

- Return or Rejection Rates: High returns lower per-customer profitability due to reverse logistics and restocking costs

- Amount of Goods Sold: Higher volume per customer boosts absolute profit, especially when combined with efficient servicing

Among all these, two sub-KPIs stand out as the most influential. We’ll explore them in more detail going forward.

Sub-KPI 1: What Is AOV (Average Order Value)?

AOV measures the average revenue generated per transaction across a defined set of customers. It reflects how much value each order contributes to your topline

Why It Matters:

- Directly impacts total revenue and profitability per visit

- Indicates whether reps are selling depth (larger baskets) or just ticking off visits

- Helps identify accounts with strong buying behavior vs. low effort transactions

How It’s Measured:

AOV = Total Revenue ÷ Number of Orders

Example: If a customer places 4 orders totaling $2,000 → AOV = $500

How to Achieve It:

- Offer bundled deals to increase cart size

- Focus on pushing premium SKUs during visits

- Set value-based goals for field reps

- Use BeatRoute to auto-suggest high-value SKU combinations

Sub-KPI 2: What Is Average Sales per Customer?

This metric calculates the total revenue generated from a single customer over a specific time frame (e.g., monthly, quarterly).

Why It Matters:

- Highlights the long-term profitability of each outlet

- Helps segment accounts by revenue contribution

- Identifies underperforming customers that need attention or upgrades

How It’s Measured:

Average Sales per Customer = Total Sales ÷ Number of Active Customers

Example: $60,000 sales from 120 customers → Average = $500 per customer

How to Achieve It:

- Increase visit frequency to encourage more orders

- Push underperforming customers using targeted schemes

- Upsell with focused product combinations

- Use data to prioritize customers with higher potential

How These Sub-KPIs Drive Customer Profitability

Together, AOV and average sales per customer reveal how efficiently each customer contributes to profit:

- Higher AOV means more margin per order, fewer deliveries, and lower cost to serve

- Higher average sales per customer boosts revenue without adding more field effort

- When both go up, servicing becomes more efficient and profitability increases naturally

Example: If 100 customers move from $400 to $600 monthly spend with stable costs, total margin grows without extra investment.

How to Drive Execution at Scale

To drive Customer Profitability daily:

- Set AOV and revenue per customer benchmarks for reps

- Focus visits on customers with high profit potential

- Track order value and SKU mix on a weekly basis

- Use smart alerts to fix low value patterns quickly

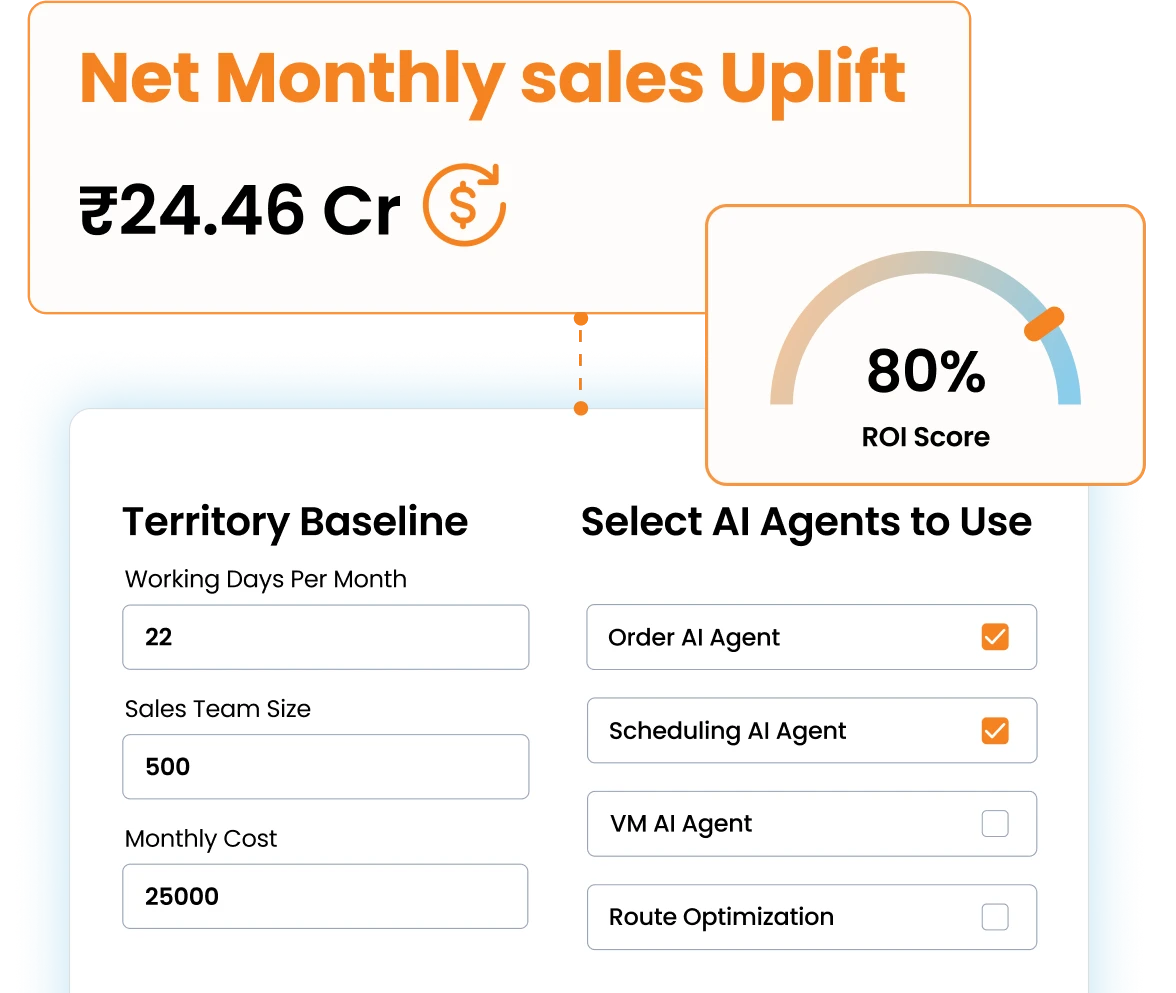

How BeatRoute Can Help

This is where BeatRoute’s Goal-Driven AI framework comes in.

- Set customer profitability linked goals for your field teams based on priority SKUs to drive quality revenue

- Empower them with agentic AI workflows to improve profitability by influencing AOV and average sales per customer through smart SKU targeting and order value recommendations

- Gamify them to improve execution behaviors e.g., smart bundling, premium SKU pitching, and high-value order conversion

- Solve customer profitability challenges like low-margin order patterns or inconsistent servicing with intelligent nudges and timely interventions from BeatRoute Copilot

Conclusion

Customer Profitability is not just about how much you sell, it’s about how wisely and efficiently you sell. It helps consumer goods brands focus efforts where margins are real.

By tracking AOV and average sales per customer, brands unlock the ability to scale profits sustainably. These KPIs guide daily field action and help fix leakages early.

With the right tools and team behavior, customer profitability becomes repeatable, trackable, and scalable creating real business impact across the board.

👉This KPI is a core execution metric recognized across the global consumer goods and FMCG industry. It is widely used to measure field performance, outlet-level impact, and sales execution effectiveness. Tracking this KPI helps retail brands align local and national execution with broader business goals like growth strategy, market expansion, and profitability.

About the Author

-

Kanika Agrawal owns deep first-hand market experience ranging from global corporations to startups, where she has contributed to building and scaling solutions that drive measurable business impact. She possesses strong expertise in AI and focuses on translating its capabilities into real business value.

Use Goal-Driven AI to Achieve Retail Sales Uplift, Today!

Join enterprises in 20+ countries that trust BeatRoute, the globally dominant AI platform for sales force automation, field sales, DMS, and eB2B

Latest Insights & Articles

Here are the most impactful articles, platform updates, ebooks and reports for you.