Outstanding Amount KPI

Outstanding Amount is the total unpaid dues owed by distributors or trade partners to the brand for goods invoiced but not yet paid. It reflects credit risk, cash flow health, and distributor discipline across territories.

For consumer goods brands, managing this KPI ensures liquidity, reduces bad debts, and helps sales teams align growth with financial compliance.

Why Outstanding Amount Matters

- Affects company cash flow and working capital efficiency

- Indicates credit exposure across partners and geographies

- Enables better risk assessment during distributor onboarding

- Supports finance‑aligned territory growth planning

- Helps drive collections accountability for field teams

How to Measure Outstanding Amount

The total invoiced amount not yet collected from distributors within the agreed credit period.

Formula:

Outstanding Amount = Total Invoiced Amount – Total Payments Collected (within credit period)

Example: If $300,000 was invoiced and $240,000 collected within 30 days, Outstanding = $60,000

Data is typically tracked through ERP or distributor management systems (DMS) and segmented by territory, credit age, or channel partner.

What Drives Outstanding Amount

- Payment discipline of distributors

- Credit terms and enforcement mechanisms

- Collection follow‑ups by field teams

- Invoice accuracy and dispute resolution

- Trade relationship maturity and financial capability

Let’s explore a key sub KPI: Payment Collected

Sub‑KPI: What Is Payment Collected?

Total value of payments received from trade partners for invoices issued within a defined timeframe.

Why It Matters

- Directly reduces outstanding and improves cash flow

- Reflects effectiveness of field follow‑up and credit management

- Supports performance evaluation of partners and regions

How It’s Measured

Payment Collected = Total value of invoices paid by the due date

How to Improve It

- Track collections with aging buckets and daily dashboards

- Incentivize reps and partners for timely payments

- Resolve invoice disputes quickly to avoid payment delays

- Educate partners on credit policy and penalize habitual defaulters

How This Sub KPI Drives Outstanding Amount

Higher and timely collection of payments reduces the overall outstanding amount, improving financial health and enabling future business scalability.

How to Drive Execution at Scale

- Set collection targets at territory, rep, or distributor level

- Monitor payment aging and alert reps for critical delays

- Align credit days and discounts with payment behavior

- Use mobile check‑in tools for collection logging

- Reward low‑outstanding territories to boost field focus

How BeatRoute Can Help

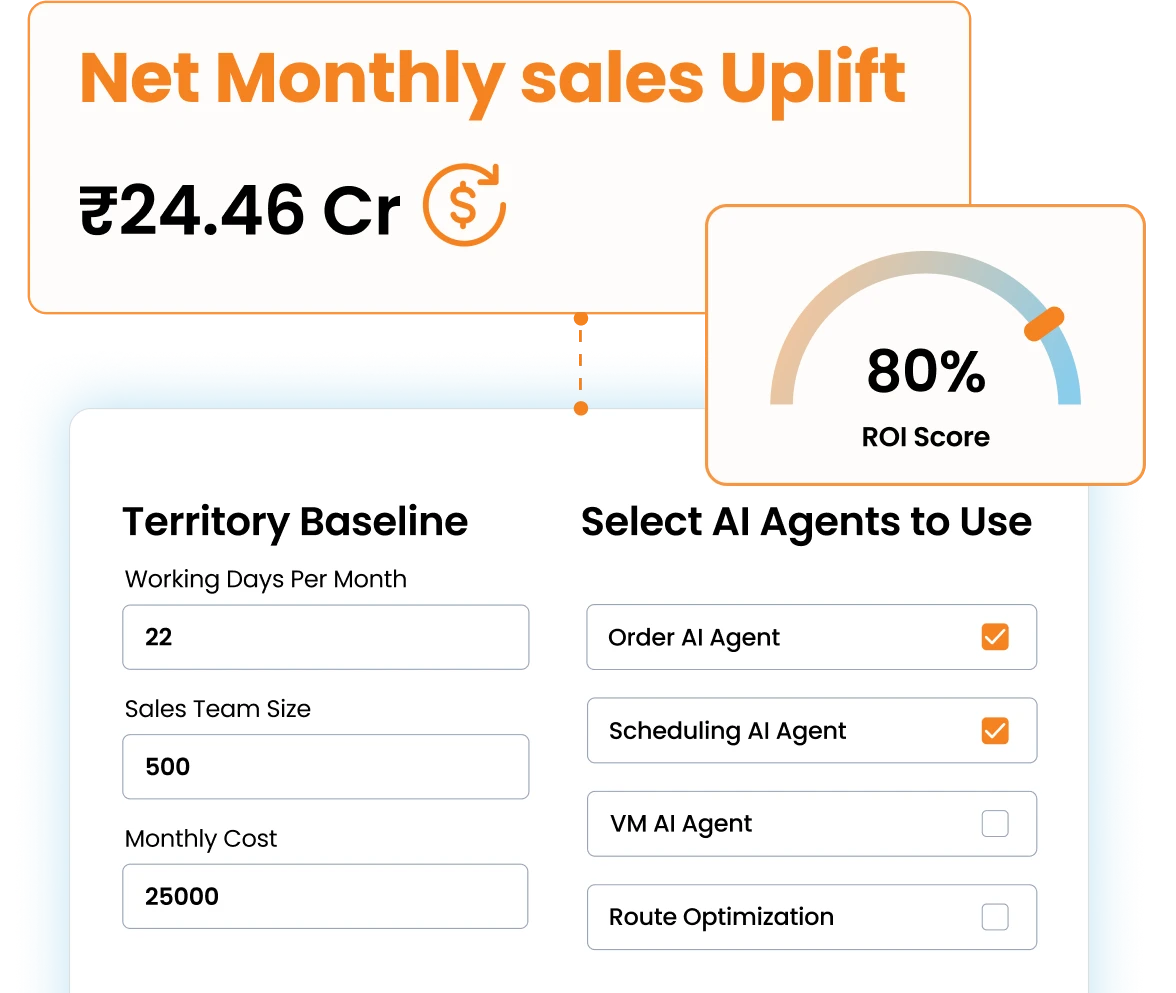

This is where BeatRoute’s Goal-Driven AI framework comes in:

- Set outstanding payment reduction targets by distributor and track real‑time performance through dashboards that show collection progress, overdue amounts, and credit exposure

- Empower reps with agentic AI workflows like Scheduling AI, which prioritizes payment visits based on aging risk, and automated nudges that include invoice reminders and balance confirmation prompts via the Sales Team App or Customer App. Streamline collections with photo-verified day-end reconciliation for payment entries.

- Gamify collection behavior through leaderboards and scorecards that recognize reps and distributors for on-time payments, reduced overdue days, and clean aging reports.

- Solve payment risks with BeatRoute Copilot, which flags high-aging accounts and payment lag clusters, then provides managers with conversational prompts like “Which partners are beyond 45 days overdue?” and recommends recovery actions.

Conclusion

Outstanding Amount is a vital financial KPI that links commercial growth to disciplined collections. Managing it well builds sustainable distributor relationships and ensures long‑term business continuity.

👉This KPI is a core execution metric recognized across the global consumer goods and FMCG industry. It is widely used to measure field performance, outlet-level impact, and sales execution effectiveness. Tracking this KPI helps retail brands align local and national execution with broader business goals like growth strategy, market expansion, and profitability.

About the Author

-

Kanika Agrawal owns deep first-hand market experience ranging from global corporations to startups, where she has contributed to building and scaling solutions that drive measurable business impact. She possesses strong expertise in AI and focuses on translating its capabilities into real business value.

Use Goal-Driven AI to Achieve Retail Sales Uplift, Today!

Join enterprises in 20+ countries that trust BeatRoute, the globally dominant AI platform for sales force automation, field sales, DMS, and eB2B

Latest Insights & Articles

Here are the most impactful articles, platform updates, ebooks and reports for you.