Goal-Driven, Intelligent Sales Platform for the BFSI Industry

Maximize lead conversions, improve customer relationships and manage direct and indirect channels effectively. Drive higher field sales productivity, ensure secure customer onboarding, and align your field teams to measurable business outcomes.

Direct Channel

Indirect Channel

Empower Everyone in Your Route-to-Market

Field Sales Executives

Direct Sales Agents

Area Managers

Relationship Executives

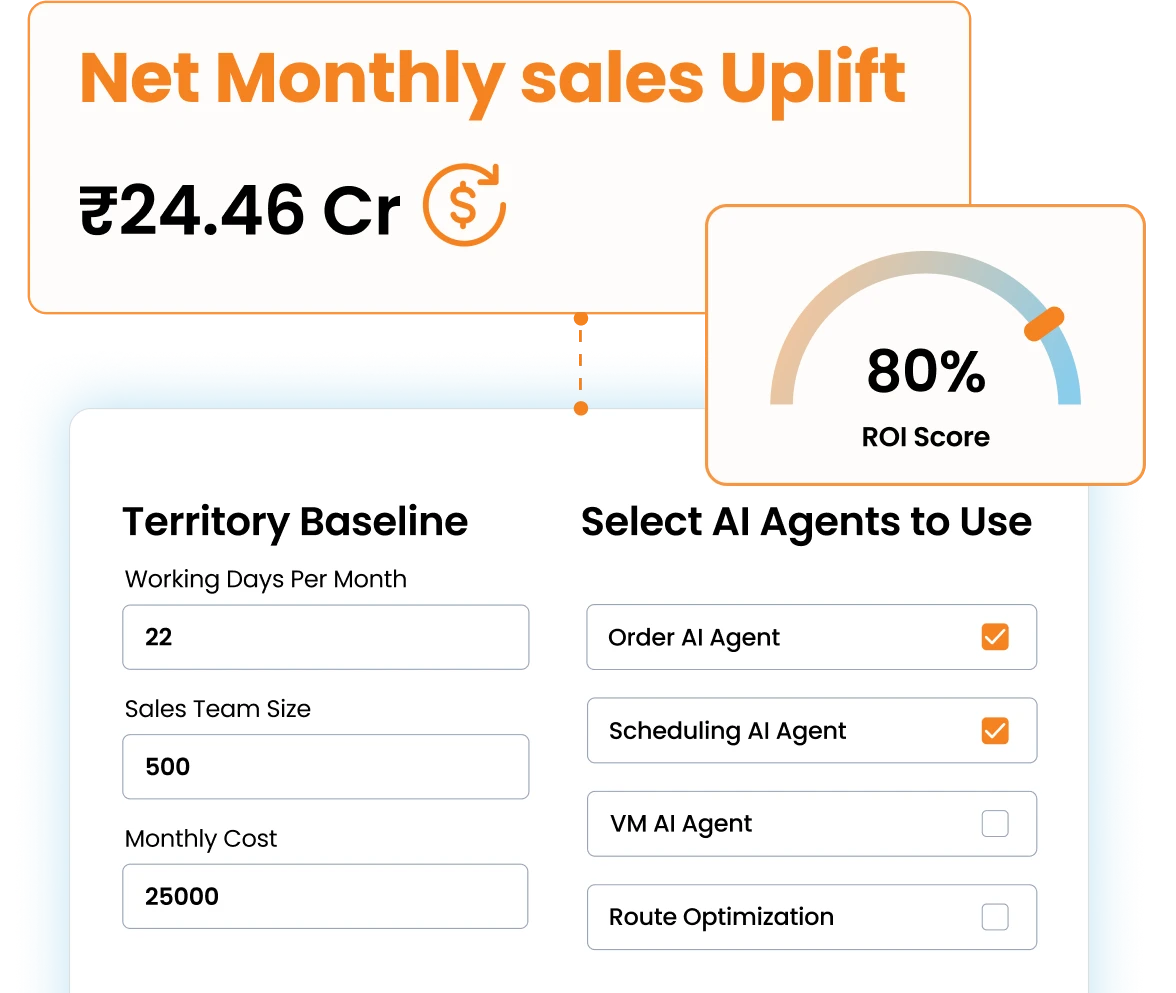

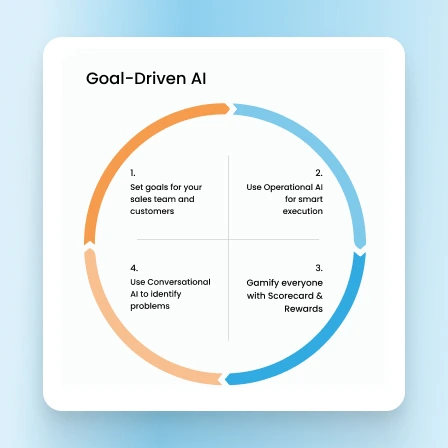

BFSI Sales Execution, Rewired with Goal-Driven AI

Transform customer acquisition, channel activation, and sales execution in BFSI with the precision of Goal-Driven AI.

1

Achieve your sales goals with Goal-Driven AI

Move beyond basic CRM digitization. BeatRoute’s Goal-Driven AI helps your teams target daily actions tied to real sales outcomes.

2

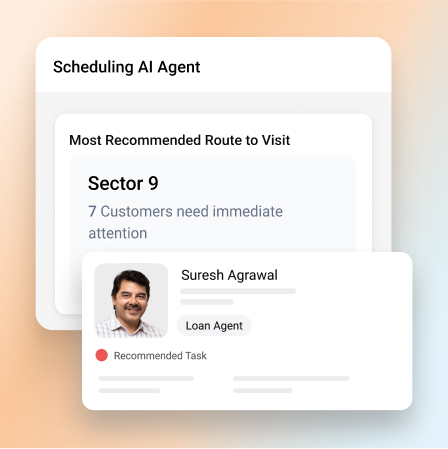

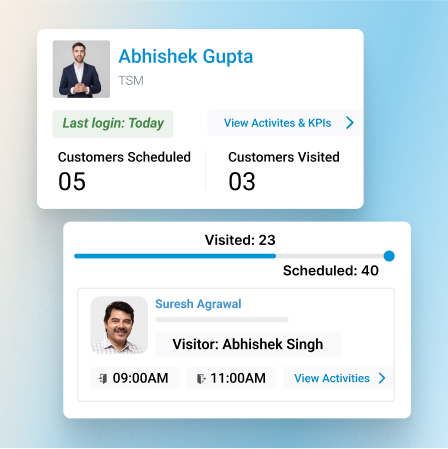

Higher Sales Rep Productivity with GPS Awareness

Ensure disciplined field activity through GPS-tagging, activity tracking, and proximity notifications for optimal territory coverage.

3

Zero Leakages with Intelligent Lead Flow

Automatically assign leads, enhance profiles through external databases, and ensure rapid follow-ups to improve conversion rates.

4

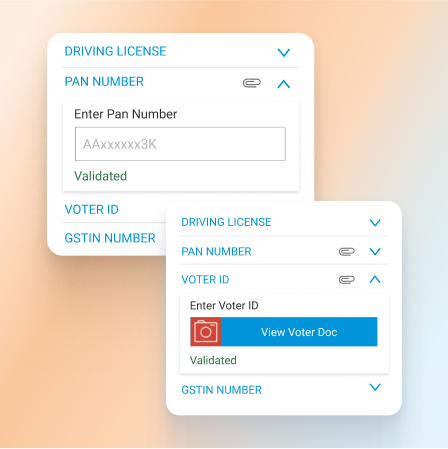

Secure and Fraud-Proof Customer Onboarding

Digitize and secure customer onboarding with AI-driven document verification, OCR technology, and masked data displays.

5

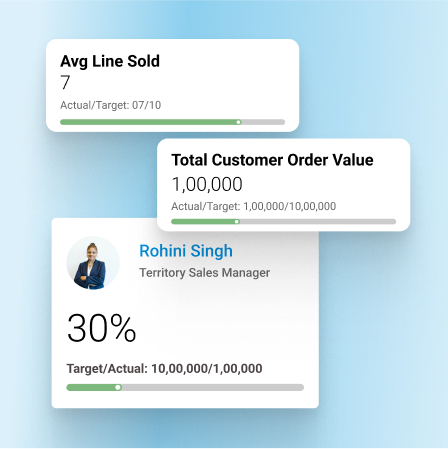

Drive Performance with Gamification

Motivate field teams with gamified KPIs and scorecards that foster healthy competition and consistent performance.

6

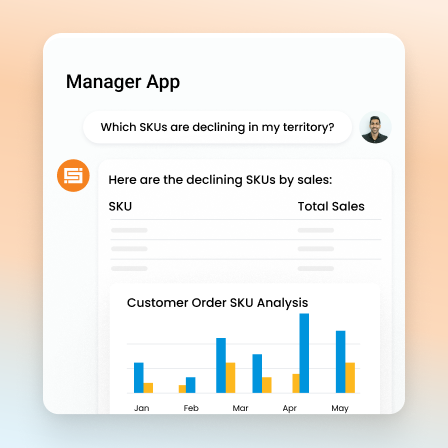

Empower Managers with Instant Field Insights

Equip managers to swiftly address idle leads, poor territory coverage, and compliance issues through actionable AI alerts.

Resources

Latest Insights & Reports

Explore the latest news from BeatRoute, and insightful resources crafted for FMCG brands.

BeatRoute OnGround with AAVA Brands

FAQ

Frequently asked questions

Can’t find the answer you’re looking for? Please contact us from this page.

BeatRoute is the best AI-powered sales software for BFSI field teams, combining scalable operations, AI-powered task automation, and goal-driven workflows that streamline lead conversion, KYC journeys, and customer onboarding across sales and service roles.

Yes. BeatRoute allows role-based access for different field functions. Loan officers can use it for document collection, insurance agents can schedule customer meetings, and RMs can track client engagement and portfolio reviews. Each workflow is customizable to your internal process.

BeatRoute combines CRM workflows like lead nurturing and onboarding with SFA features like visit planning, follow-ups, and document capture. Sales teams get a 360-degree view of lead status, while managers track execution KPIs like conversion rate, visit quality, and customer satisfaction.

BeatRoute’s AI engine suggests the best time and location to meet high-potential leads, flags overdue follow-ups, and prompts teams on upselling opportunities. AI nudges reduce missed visits and increase cross-sell or renewal rates across products like loans, insurance, and savings plans.

Yes. BeatRoute supports onboarding journeys with mobile-based KYC capture, document uploads, and automated progress tracking. It helps sales teams complete account opening, loan disbursal, or insurance activation right from the field.

Yes. BeatRoute is designed with enterprise-grade security, access controls, and audit trails. It ensures role-based data access, GPS-stamped visit logs, and timestamped customer interactions to help meet regulatory standards.

Yes. BeatRoute integrates with core banking solutions, CRMs like Salesforce, and insurance management platforms. You can sync customer data, transaction history, and funnel progress in real time to streamline field-to-backend coordination.

Deployment typically takes 3 to 5 weeks. BeatRoute supports phased rollouts based on geography, product line, or user group. Our team provides full support across integration, onboarding, and adoption.

Yes. BeatRoute enables goal tracking for every field user. Whether it is SIP conversions, policy renewals, or premium collection, goals can be assigned and measured in real time to boost accountability and performance.

BFSI clients using BeatRoute have seen faster lead conversion, improved KYC completion, and stronger field force discipline. The platform connects execution with outcomes, making it easier to measure field team impact on revenue.

You can simply request a free demo here and our team will not only give you a live demo customized to your needs, but also assist you in your evaluation process.