Driving FMCG Route-To-Market in Africa: Market Opportunities and the Role of Technology

The FMCG sector is characterised by low cost products made for daily use (generally) with a low margin that brands try to offset by selling in large volumes or in range to get more out there. Food, beverages, personal care, and home care products all fall under the FMCG umbrella and leading companies deal with tremendous competition by establishing brand loyalty. A steady rise in consumption can be observed over the last decade or so in the FMCG Africa market with retail spending recorded at $1.4 trillion in 2016 with Nigeria being the largest market at $350 billion.

The most evident growth drivers are population rise, increased disposable income among consumers, and fast urbanisation. With urbanisation came ecommerce preference and this is estimated to generate about $67.8 billion by 2027. Traditional or informal retail currently makes up the bulk of the FMCG market in Africa, but formal trade is also seeing rapid growth with the advent of retail chains and government initiatives.

Despite such promise in recent times and all the merits mentioned above, the African FMCG sector is not without its share of challenges that need to be identified and addressed. One of the primary challenges is the slow adoption of the digital medium in both rural and urban zones, where human efforts on the ground are not supported by technology, creating communication and process gaps that can degrade business relationships and ultimately, sales.

To keep up with global standards, it is very important for FMCG brands in Africa to widen their views, understand the evolving FMCG market, understand that a human-digital synergy is the way forward, and implement steps accordingly. They need something that goes beyond usual elements like tracking and record keeping, but more importantly something that brings everyone in the route to market together on a common platform and with shared goals.

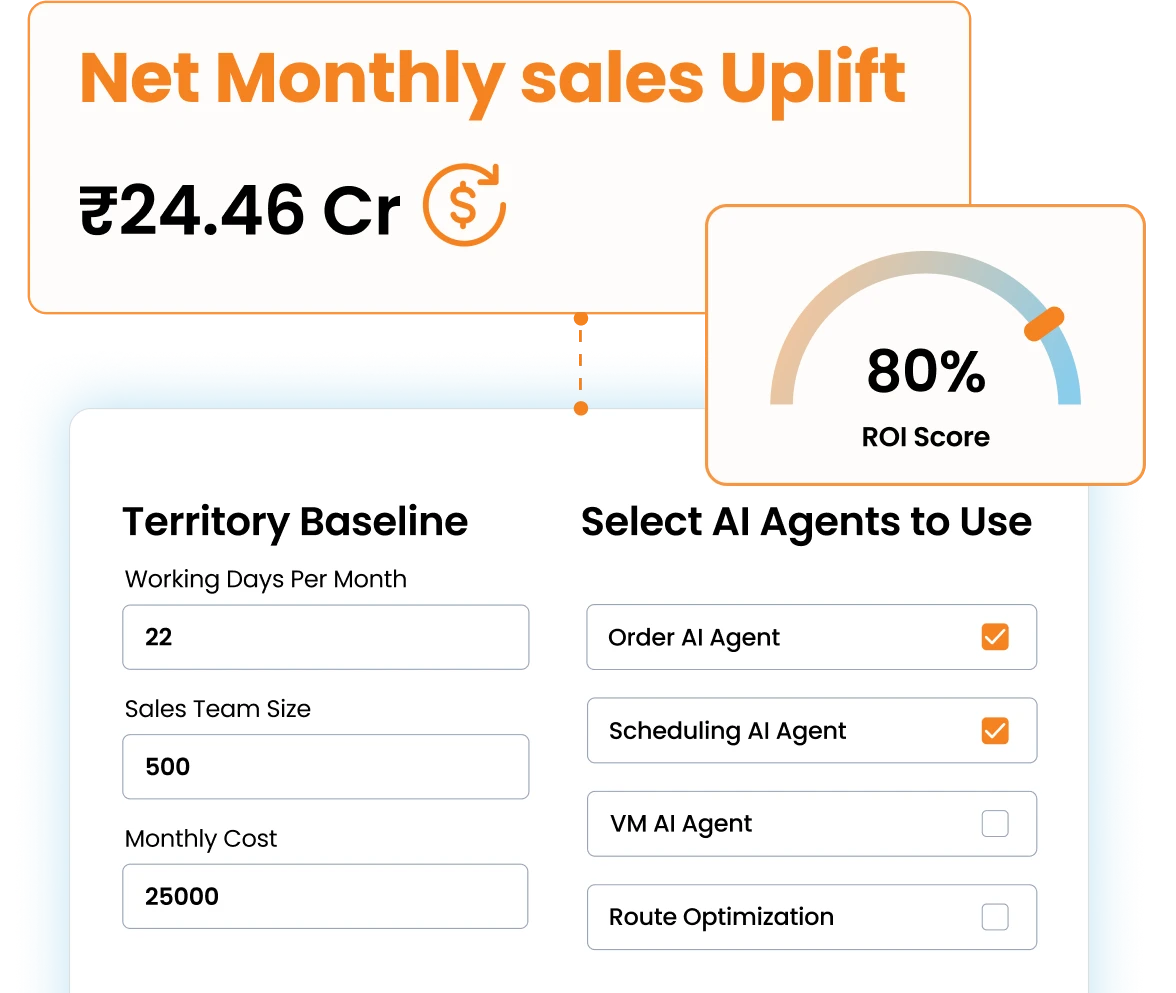

They need something like BeatRoute that has already helped scores of customers or brands on their sales journey.

What is BeatRoute?

BeatRoute is a goal-focused sales enablement platform that brings all your route-to-market stakeholders – sales teams to retailers and everyone in between – on common ground towards achieving your sales goals. We promote collaborative automation where human efforts are supported by digital means to create a proper synergy between them. Leading brands all over Africa trust us with their retail sales and distribution because of what we bring to the table. And once you are through this piece, you will not only grasp our understanding about FMCG sales in Africa but also how we can help enhance your bottom line here.

The goal of this article is to discuss the FMCG market in Africa, the challenges, and highlighting how BeatRoute, as a sales enablement platform, can help your brand.

The FMCG Sector in Africa

Traditional Retail – The African continent is dominated by traditional retail that is not as prevalent elsewhere. These are mostly unlicensed or unregistered retailers operating in kiosks or street-side stalls, making it a logistical roadblock for retail brands and the need for more localised distribution strategies crucial.

Spending Preference – African consumers, particularly those away from large metropolises, prefer to spend only on essential goods because of low average incomes. But there has been a steady rise in disposable income in areas with steady economic/political conditions, meaning that the sale of luxury products (cosmetics and personal care) are also rising. This is construed, although not conformed, to be a side effect of exposure to Western cultures through phones and the internet.

At present, consumers of FMCG products are more inclined to buy cheap, staple food items but as mentioned above, rising incomes will nullify this trend and lead to a greater demand for a range of FMCG offerings, which means a range of FMCG products (even premium) will enter the African markets in increasing volumes.

Brands will then need assistance through human-digital synergy in retail placement, merchandising, ordering (primary and secondary), visit hygiene measures, stock keeping, complaint resolution, etc. to keep up with this evolving situation. With BeatRoute, they get all that but with a goal-focused approach supported by collaborative automation throughout the route to market.

FMCG brands have potentially lucrative opportunities in the African continent and establishing their presence early on with digital assistance will help them reap the benefits of present quantity-focused sales along with the eventual shift towards more varied sales.

Pro Tip: A retail audit can provide you with actionable insights. We’ve created an effective retail audit checklist with 10 steps to help boost sales.

Local Needs and Consumer Habits – Before onboarding retail stores and setting up a distribution network in a region, understand that a successful route-to-market is much more that that. It must be understood that economic, climatic, and other factors distinguish what sells in countries in Africa. For example, hair care products that work in one African country or part may not work in another. An understanding of conditions and customizing products based on them is what translates as a top-selling product.

As for consumer habits, there is a trend to buy close to home and buy from a small group of retailers where consumers can enjoy loyalty benefits; consumers also tend to buy with value for money in mind. Naturally, this also affects the type of SKUs/items that are purchased in primary and secondary sales as opposed to other places.

Distribution Differentiation – African countries witness a lot more traditional trade than modern trade because of the continent’s heavy reliance on traditional retail stores, particularly in rural zones. Infrastructure issues such as poor roads and limited transportation affect distribution to remote or rural areas a lot, and even urban areas in some less-developed nations.

There is a strong dependence on local distributors in these regions, and the sheer number of such instances fragments the supply chain, causing confusions, delays in issue resolution, and even understocking. On this note, African consumers prefer to shop daily or in short frequencies from local general trade stores due to mostly limited disposable income, meaning that keeping sufficient stock is also a frequent affair.

Comparative Lack of Competition – Brands in African countries such as South Africa have a dearth of competition; the top 10 brands occupy over 50% branded goods sales, thus giving them immense influence over pricing and distribution. Dominating the market allows these brands a lot of power as consumers don’t have a lot of options with no one to challenge their position. Having a top-of-the-line distribution system and leveraging all-round collaboration via automation could be the secret sauce for new brands/entrants in African markets.

| Rural Market in Africa | Urban Market in Africa |

| Low disposable income. | High disposable income. |

| Preference for essential products with modest financial means. | Higher incomes+urbanisation+growing middle class allow for a preference for premium products. |

| Very limited infrastructure means a reliance on traditional retail and smaller stores. | More prevalence of modern trade stores such as supermarket chains due to comparably better infrastructure. |

| Non-digital and more traditional marketing tactics like word-of-mouth are more effective. | Consumers are more exposed to global and national brands due to greater access to TV, social media, and the internet. |

| Low technology adoption among route-to-market stakeholders, severely limiting a brand’s sales efforts in such areas. | Urbanisation uplifts technology adoption such as smart phones for retailers and distributors. |

African Countries with Promising FMCG Markets

- Nigeria

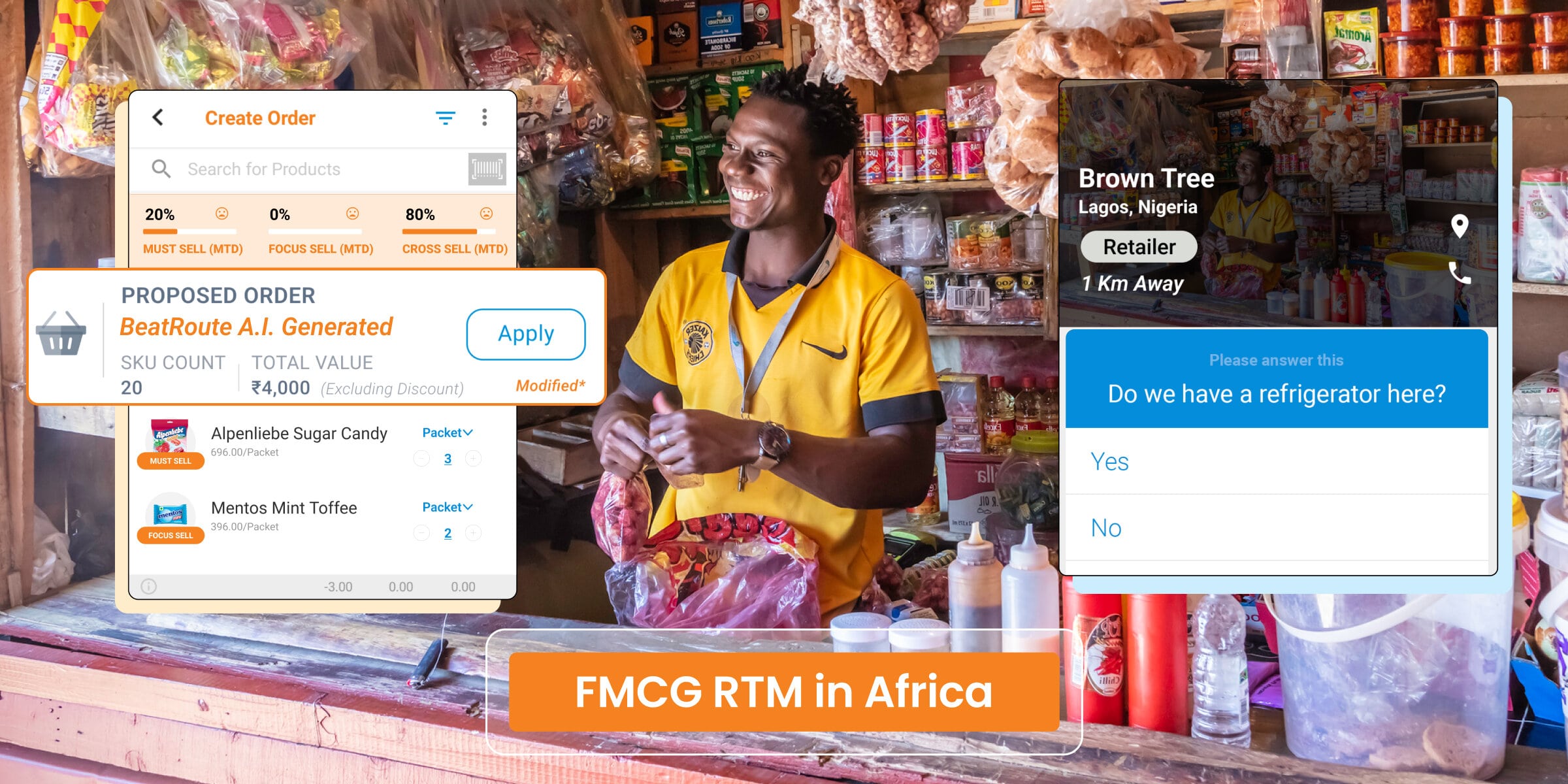

It is a fact that traditional retailing takes up about 90% of all retailers in Nigeria. The country is witnessing a rapid change in their trade scene, gradually moving from traditional trade to modern trade with the rise of shopping centres and supermarket chains, giving FMCG brands a solid foothold. In terms of food and beverages, Nigerians were always preferential towards unprocessed or semi-processed foods that were cheaper and more available.

However, with the aforementioned increasing disposable incomes and rapid urbanisation in some parts, brands are getting more penetration and selling more and more processed food and beverages at retail outlets. Despite all this, the geography of the country and a lack of ready infrastructure requires brands to set up local distribution centres.

This helps in the following ways:

- Nigeria’s roads and transport networks can be challenging and this makes establishing local distribution centres in strategic regions to reduce distributor to retailer delivery that much critical. For the FMCG industry, where sudden restocking may be necessary via timely order delivery, local distribution hubs or warehouses can make a huge difference, enhancing customer (retailer) satisfaction and market reach.

- Local distribution can enable brands to store goods closer to stores, reducing transportation costs and the impact of fluctuating fuel prices, significant factors in Nigeria. Local distribution centres also offer more brand control over inventory and stock availability, preventing stock outs that can damage a brand’s reputation. A local presence also helps manage the unique logistical challenges that can arise from Nigeria’s large size and regional diversity.

- Leveraging technology such as BeatRoute in local distribution centres, retail outlets, and in the hands of sales teams allows for better stock keeping, timely ordering, product awareness, route optimisation, effective complaints management, and more, all of which contribute to faster product movement across the supply chain to the consumer, i.e. offtake. We bring all your stakeholders including distributors on the same platform that ensures that your route to market is as unhindered as possible, boosting your bottomline. With digital solutions, companies can accurately monitor sales, stock, and demand in time, helping them recalibrate their strategies efficiently.

- South Africa

South Africa is experiencing rising costs of living but despite this, its FMCG sector continues to boom in certain categories like food and personal care items. Essential items are in high demand and the country enjoys a highly-developed retail infrastructure, with the modern trade channel offering significant penetration across the country. This makes it easier for FMCG brands to distribute products and connect with more retailers when there is already a broad customer base available.

To break it down, traditional retail stores such as spaza shops in South Africa cater to much of the population, particularly in rural areas. Important to lower-income groups for basic needs who focus on affordability, these shops serve as a critical juncture in a brand’s route to market in such areas. Understanding the local market and establishing an efficient supply chain is as crucial here as elsewhere.

As traditional retail outlets operate on tight margins already, it is important for brands to recognise this and only place affordable products in stores to ensure good offtake and repeat sales. Traditional retail stores remain a strong aspect of the South African retail scene because of their general proximity to consumers and also because of their interpersonal relationships with consumers.

Brands must also ensure strong B2B relationships as aligning with successful retailers can ensure stability and expansion. Additionally, experts say that traditional retailers will continue to dominate 65-75% of sales till 2030, especially with their willingness to modernise their business, such as going digital, making them very relevant to brands in South Africa and beyond.

South Africa’s position as a key economic hub in Africa means it can be a gateway for FMCG companies that want to expand across Africa. With its more sophisticated distribution networks, South Africa is in a great position to lead the FMCG sector and this could be very lucrative for brands, but only if they develop strategic B2B partnerships with retailers and gain a strong understanding of market dynamics.

- Egypt

Egypt’s FMCG market has recently experienced a growth of 45.3% in terms of sales volume in 2023, with categories such as dairy and snacking going into decline with food and beverages seeing an uplift. The consumers prefer to spend on essential items with a strong focus on in-home consumption. Smaller pack sizes sell more because of a decline in disposable income than before and local products take precedence over global brands because of their cost-effectiveness and accessibility.

For brands, traditional channels in Egypt such as grocery stores and corner outlets had always been the primary drivers of sales but although they were apparently helpful for consumers who wanted near and affordable options to buy essential products such as on credit, they were a constant problem for brands in terms of stock-keeping and product availability. On the other hand, modern retail stores with better layout and infrastructure, allowed for more product placements and better stock keeping. The issue with most traditional retail stores in this respect could be the inability to adopt digital measures to maintain stock or self-order or perhaps the inability of brands (particularly local) to create a proper goal-driven sales strategy for their needs.

The Role of Technology in FMCG Sales Enablement in Africa

FMCG brands in Africa are investing in technology towards improving both customer service and gathering information that is critical to seamless route to market operations. As an example, consider that Cadbury equips its sales teams in South Africa with mobile devices enabling them to audit inventory and place orders efficiently. Many brands may also use such devices to access account data, map sales rep routes, and document planograms through photographs. Ultimately, the proper and timely use of such technology will only contribute to successful operations, data accuracy, and most importantly, informed recalibration of existing strategies.

The African continent’s mobile phone users, although inconsistent across countries, has over 500 million unique subscribers. This means that with user-friendly tools that offer true value to stakeholders of a brand’s route to market, there is a big chance for retailers and distributors to adopt mobile-based technologies that assist them achieve sales goals.

Digital tools are already improving operational efficiency regarding product movement and by facilitating better inventory visibility. This helps FMCG brands maintain smoother operations and meet consumer demands more effectively across Africa. A sales enablement platform like BeatRoute can not only help with the above but also empower every level of your FMCG route to market in Africa to contribute to your sales goals as a brand. We will talk about that in a later section.

How Digital Tools Can Help Fix FMCG RTM Issues in Africa

When it comes to a sales rep visiting stores for taking orders or for onboarding, a digital solution always trumps physical data capture because the latter is prone to oversight and human errors. For instance, sales reps can use a reliable field sales app to collect information like sales potential, store size, consumer demographics, and in-store space during the onboarding process. This information can then be passed on in the backend for sales managers to analyse and approve/disapprove a store for onboarding. All decisions taken in this manner are fact-based and depend on data rather than assumptions, ensuring repeat sales and preventing misaligned retailers from being added to a brand’s retail network.

Robust and modern digital solutions also help brands prioritise stores that are more likely to provide repeat business because by highlighting stores that offer better long-term sales potential, pushing sales reps to focus on them. This enhances sales team efficiency and ultimately, boosts revenue. Moreover, enhanced reporting and analysis allows managers to monitor sales performance across regions and form strategies based on comprehensive analysis of captured information. All of this ensures that the brand-store relationship is mutually beneficial and that adequate resources are allocated to stores with the most promise.

What a Sales App Is and What It Can Do For You

A sales app is designed to support field sales activities and digitise sales operations to support a sales team. It also improves productivity by enabling field managers to efficiently oversee store visits by sales reps within their territory and take corrective actions when required. The sales app equips FMCG organisations with modern solutions, streamlining the daily tasks of their sales teams.

- A reliable sales app allows efficient order taking and scheme application without needing to commit everything to memory.

- It allows for effective store audit via photo and video capture to ensure there are never overstocking or understocking issues and also to ensure all merchandising is up to agreed standards.

- It allows for an efficient complaints redressal system that the sales team can utilise to register and accurately track complaints.

- Sales reps can use it to capture store details like sales potential, store size, consumer demographics, and in-store space, which can then be assessed by sales managers or the concerned department before onboarding a store.

What a DMS Is and What It Can Do For You

As a software or digital tool that brands can use to optimise their distribution process and improve primary and secondary sales performance, the DMS is invaluable. The ideal DMS offers visibility to both brands and distributors on matters like stock, order tracking, distributor rewards, etc., ultimately ensuring timely supply of goods from brand to consumers.

- DMS allows a distributor to place orders with the brand or view secondary orders flowing in from retailers or sales apps, marking dispatch.

- It supports resource management with effective deliveries, returns, and payment collection, and utilising comprehensive reports to help with sales goals.

- Offers visibility on all transactions, credit notes, and invoicing.

What a Customer/Retailer App Is and What It Can Do For You

A customer app is what enables and inspires retailers to meet their own goals, thereby fulfilling the brand’s goals. From ordering to being educated on new launches to having visibility on schemes to being informed on about a complaint’s resolution stage, the ideal customer or retailer app covers a lot.

- The ideal customer app allows retailers to check their transactions, statements of account, credit and debit notes, etc.

- Retailers can self-order in the absence of a sales representative.

- Retailers have visibility on their complaints and the resolution stage.

- Education on products and new launches.

- BeatRoute’s CuesBot nudges retailers about low stock or about new schemes or about the next milestone.

A Case Study of How BeatRoute Helped One of Its Customers in Africa

A leading FMCG brand in Nigeria was plagued with issues like having a low ratio of productive retail stores, underperforming sales reps, average order sizes that were nowhere near expectations, and limited distribution channel throughput. To address and fix these, they used BeatRoute’s Field Sales App, which helped align sales reps and sales managers achieve their goals. Gamification, scorecard KPIs, and a rewards system motivated their teams to achieve these goals.

Additionally, they used BeatRoute’s Distribution Management System to improve visibility across their order-to-cash and order-to-dispatch cycles. This provided considerable control over the end-to-end process, enhancing distribution channel throughput. By unifying their sales, marketing, visual merchandising, and distributor operations on a single platform, they created strong synergy across their route-to-market strategy.

To further boost performance, they also adopted our Van Sales Automation Software, implementing a goal-driven framework for their van sales teams. This helped improve van sales output and overall productivity.

What Does BeatRoute Bring to The Table?

As already discussed, BeatRoute is a goal-driven sales enablement platform that not only provides automation for your RTM operations but more importantly, it is a single platform for everyone in your FMCG RTM – distributors, sales reps, sales managers, influencers, product promoters, retailers, and dealers – to work towards common goals. What this kind of collaboration does is that everyone is able to work towards your ultimate sales goals (also incentivised by a robust rewards system and visibility) while AI-driven workflows improve sales performance further.

BeatRoute enables your:

- Sales teams to take orders more successfully (AI order recommendations and auto-scheme application, product education), do effective audits, and nurture brand-customer relationships.

- Distributors to have full visibility into primary sales, secondary sales, rewards, and their own stock.

- Retailers to self order (when needed), learn about product launches, lodge and track complaints, and check statements of accounts.

To elaborate and break things down, let us segregate between the different aspects of BeatRoute such as its sales app, DMS and the retailer app and show you precisely how we can make a big difference to your FMCG route to market in Africa.

Sales App

Sales Planning and Territory Management

- GPS Tracking and Beat Planning: Efficiently plan routes and track field reps in real-time. Helps in scheduling beat plans and ad-hoc visits to optimise coverage.

- Territory Mapping: Define and manage sales territories to ensure balanced workload distribution and optimal market reach.

Order Management

- AI-Enabled Order Taking: Our operational AI suggests orders for sales reps based on customer history, stock levels, and promotional schemes. Available on sales app for reps and on WhatsApp/Viber BOT for retailers/customers.

- Scheme Application: Automate the application of promotional schemes and discounts, ensuring accuracy and consistency across orders.

Customer Engagement and Profiling

- Customer Profiling: Collect and update customer data, including sales history, preferences, and purchasing behaviour, enabling better customer relationship management and mitigating incorrect onboardings.

- Store Audit and Compliance: Allow sales reps to audit stores using photos and videos to check stock levels, product placement, and merchandising compliance for backend assessment and timely rectification (as needed).

Performance Management

- Goal Setting and KPI Tracking: Set specific sales goals using Key Performance Indicators (KPIs) and track individual and team performance. Examples include sales volume, range selling, and merchandising standards.

- Gamification: Motivate sales reps through a points system, leaderboards, and rewards. Encourages consistent performance and improves sales team behavioural aspects.

- Education and Training: Upload product information and launch details on the same platform, ensuring continuous improvement and on-field efficacy.

Execution and Compliance

- Promoter and Merchandiser Management: Track and improve in-store activities, including merchandising, ensuring products are well-stocked, properly displayed, adhering to planograms, and promotional activities are executed effectively.

- Van Sales Automation: Manage on-the-go sales for van-based distribution models, including inventory tracking, order processing, and payments.

- Complaint Management: Register and track complaints from customers or retailers to ensure timely resolution, while providing complete visibility to all stakeholders during the resolution process.

Reporting and Analytics

- Data and Insights: Access latest data on sales activities, order statuses, stock levels, and sales rep performance, enabling quick decision-making.

- CuesBOT: An AI tool that identifies execution challenges and provides insights without manual analytics. Offers actionable recommendations for improving sales strategies.

Cross-Channel Sales Support

- General Trade: Enhance retail relationships by improving order sizes, product availability, and in-store engagement.

- Modern Trade: Focus on improving visibility, product availability, and share of shelf space in supermarkets and hypermarkets.

- B2B/HoReCa: Streamline sales processes for business customers, including hotels, restaurants, cafes, and salons.

Task and Workflow Automation

- Task Scheduling and Tracking: Create, assign, and track tasks, ensuring all sales activities, from store visits to promotions, are completed as planned.

- Automated Reminders and Alerts: Ensure reps are notified of tasks, follow-ups, and goals, improving compliance and productivity.

DMS

Efficient Distributor Operations

- Inventory Management: Track inventory levels across distributors in real-time, ensuring optimal stock levels without manual errors.

- Stock Replenishment: Receive automated stock replenishment suggestions based on sales data, helping distributors maintain consistent availability.

Sales Tracking and Reporting

- Secondary Sales Data: Capture and analyse secondary sales to understand product performance and market demand, aiding better planning and forecasting.

- SKU-Wise Reporting: Monitor secondary sales at an SKU level to identify top-performing products and those needing more support.

- Performance Analytics: Track sales performance across distributors and regions, providing insights into trends and distributor effectiveness.

Financial Management

- Credit Control: Manage credit limits and payment terms for distributors, reducing the risk of defaults and ensuring financial control.

- Billing, Invoicing, and Reconciliation: Enable invoice generation and payment tracking, simplifying the billing process, and ensuring accurate financial records.

Scheme and Promotion Automation

- Scheme Management: Automate the application of promotions and discounts, ensuring consistency across all distributors.

- Real-Time Scheme Visibility: Provide distributors with up-to-date information on current schemes to maximise their benefits.

Distributor Self-Service Portal

- Order Placement and Tracking: Enable distributors to place orders directly through a self-service portal, with real-time tracking and updates.

- Sales and Stock Reports: Access comprehensive sales and stock reports to support informed decision-making.

- Complaints and Support: Simplify the process for raising and resolving complaints, ensuring prompt support and maximum transparency.

Real-Time Communication

- Instant Alerts and Notifications: Send real-time updates on orders, dispatches, and promotions to distributors, facilitating smoother coordination.

- Digital Collaboration: Improve communication between sales teams and distributors, reducing delays and improving efficiency.

Integration Capabilities

- ERP and Third-Party Software Integration: Seamlessly connect with ERP systems and other tools, ensuring smooth data flow and reducing manual entry.

Retailer App

Easy Order Placement and Tracking

- Self-Service Ordering: Retailers can place and track orders directly through the app, with intelligent order suggestions based on past purchasing patterns and focus SKUs.

- Real-Time Updates: Receive instant notifications on order status, promotions, and offers.

Access to Schemes, Promotions and Loyalty Programs

- Scheme Visibility and Automation: View ongoing promotions and have applicable schemes automatically applied during order placement.

- Loyalty Program: Earn rewards and incentives based on buying specific SKUs, or on purchase volume, encouraging cross-selling, repeat business and brand loyalty.

Two Way Communication and Support

- Feedback Collection and Issue Management: Capture feedback from retailers and enable them to log complaints or queries, with updates on resolutions.

Payment and Credit Management

- Flexible Payment Options: Multiple payment methods such cheque, cash etc, along with the ability to manage credit terms and view outstanding balances.

For more details, you can check out our page – https://beatroute.io/sales-force-automation-for-fmcg/. You can also read our article on FMCG route-to-market success – https://beatroute.io/blog/fmcg-industry-route-to-market/.

Conclusion

Success in the FMCG industry in Africa depends strongly on resolving challenges throughout the entire route-to-market process. All key stakeholders such as sales teams, distributors, and retailers are crucial to a brand’s sales performance. From effective audits to insights gleaned from said audits to successful ordering to complete visibility on transactions and performance, ours is a platform that bolsters human efforts on the field and enables every stakeholder to work together towards shared goals.

To maintain market dominance in Africa, it is important to stay in control of your route to market and understand unique nuances such as consumer preferences, the ever changing FMCG landscape in countries across the continent, and recognising growing product demands and preparing for it with the right tools.

BeatRoute has helped many leading global brands to achieve their route-to-market goals through its flexible and scalable platform and can do the same for you.

You can request for a free demo here.

About the Author

-

Apart from being a Senior Content Writer at BeatRoute, Soham is an avid reader of science fiction and suspense novels (Doyle, Christie, Brown or anybody great!) He also dabbles in historical narratives and wonders about our place in the universe. Cosmic viewpoints, Carl Sagan, and Neil deGrasse Tyson intrigues him. When not reading, you may find him spending his weekends or after-work hours watching a fulfilling movie with his family.

Use Goal-Driven AI to Achieve Retail Sales Uplift, Today!

Join enterprises in 20+ countries that trust BeatRoute, the globally dominant AI platform for sales force automation, field sales, DMS, and eB2B

Latest Insights & Articles

Here are the most impactful articles, platform updates, ebooks and reports for you.